Caribou (formerly MotoRefi), a Washington, DC- and and Denver, CO-based auto fintech enabling people to take control of their car payments, closed $115 million in Series C funding round, which brings the valuation to $1.1 billion

The business accelerator, the seed capital fund and the VC firm will collaborate to grow the companies in their portfolios.

Carter Bank & Trust’s former Chairman and CEO Worth Harris Carter did not believe the bank needed to digitally transform,...

Humans like to create images, starting with cave paintings. Then came prints, cartoons, and finally video gaming, a major occupation of a good fraction of the world's population. It's a short step from video games to Bitcoin and NFT's.

Carvana has filed for a US initial public offering (IPO) and plans to list its shares on the New York Stock Exchange with the ticker symbol CVNA; the online auto dealership sells its cars from vending machines located across the US; the company is planning to raise $100 million from the IPO and is working with investment bankers at Wells Fargo, Bank of America, Citigroup and Deutsche Bank on the deal; its registration statement reports significant risks including higher public registration costs and profitability uncertainty. Source

Carvana is working with Wells Fargo and Bank of America on plans for a US initial public offering (IPO); the company is one of a few specialist providers selling used cars and offering auto financing through the internet with automated towers storing vehicles in cities such as Austin, Dallas and Nashville; Reuters reports the company has a valuation of $2 billion and is planning for its IPO in the first half of 2017. Source

Casai, which offers short stays in premium accommodations with integrated technology, has quadrupled in size since arriving in Brazil in 2021.

·

“It’s not enough to have a 1-800 number that people call, and the person still says it’ll take 90 days....

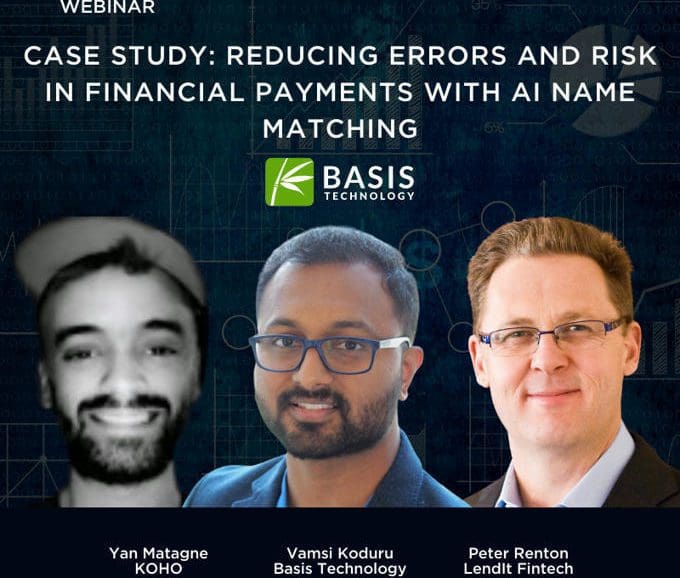

In this webinar, we’ll discuss KOHO’s journey with Rosette name matching, explore KOHO’s initial challenges.

The Facebook and Amazon failures remind us that vague talk about networks and clouds and blockchains is no substitute for the kind detailed risk analysis and countermeasure planning that will be required to create the next piece of vital national infrastructure: CBDCs.