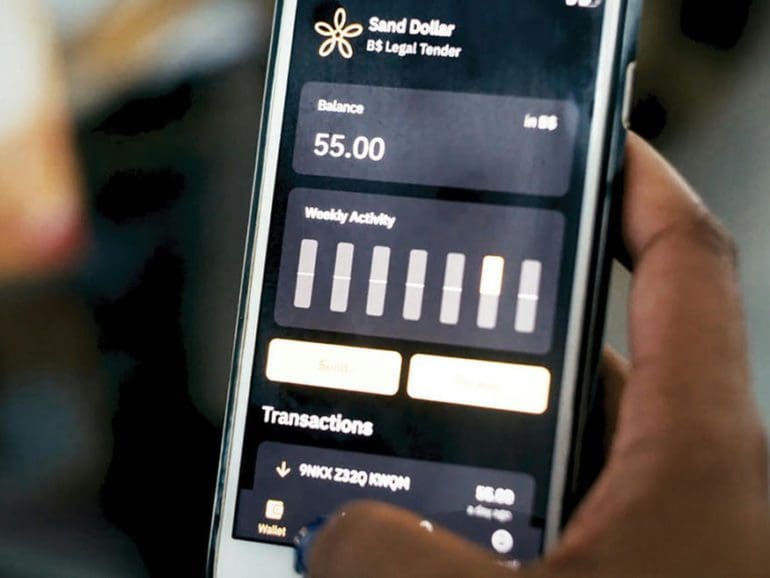

Financial exclusion is a global problem, through strategic design and implementation, could CBDCs be the solution?

Financial exclusion is a global problem, through strategic design and implementation, could CBDCs be the solution?

CBOE CEO Edward Tilly told the Financial News that recent criticism about bitcoin futures was “uncalled for”; “I think letters like that and cheap shots to our regulator, the CFTC, are uncalled for to make it seem this was an overnight self-certification without the proper amount of CFTC involvement,” explained Mr. Tilly; he explained that the Options Clearing Corporation clears the contracts for the CBOE and was comfortable with their decision of bitcoin. Source.

The CBOE will launch bitcoin futures on Sunday December 10th and said that trading will be free for the first month; “We are committed to encouraging fairness and liquidity in the bitcoin market. To promote this, we will initially offer XBT futures trading for free,” commented Ed Tilly, Chairman and Chief Executive Officer of CBOE; CBOE’s bitcoin futures will trade on CFE un the ticker XBT. Source.

The CCAF released a report showing the impact of COVID-19 on fintech. The verdict? Growth and the potential for increased financial inclusion.

The CCAF released a report showing the impact of COVID-19 on fintech. The verdict? Growth and potential for increased financial inclusion.

The Cambridge Center for Alternative Finance (CCAF) has released its first report on the alternative finance market, titled, "Africa & Middle East Alternative Finance Benchmarking Report"; the report was created with support from Energy4Impact, UKAid and CME Group Foundation; for 2015 the report cites growth of 59% and a total market of $242 million; Robert Wardrop, executive director at the CCAF says development trends in Africa and the Middle East had a different focus which was on equity crowdfunding and online micro finance as opposed to consumer and business P2P lending in other global markets. Source

The UK's Cambridge Center for Alternative Finance (CCAF) is actively involved in industry research and is currently doing three alternative finance surveys; much of the research is in conjunction with the Financial Conduct Authority (FCA), providing insight for its crowdfunding consultation period; CCAF is surveying crowdfunding investors and crowdfunding borrowers; CCAF has also announced it will now be doing a survey on blockchain and cryptocurrencies; as part of the FCA's regulatory study, CCAF is working with 25 crowdfunding and P2P lending platforms in the UK to gain greater insight into the crowdfunding ecosystem. Source

Current Expected Credit Loses Standard or CECL goes into effect in 2020, though banks are now starting to experiment with technology solutions to solve the problem it causes; the requirement forces banks to put potential loan losses on their books when they put an asset on their books; right now it can take a bank almost a week to go through a largely excel driven process; beginning to implement changes now can help banks stay ahead and begin using technology to solve other data driven problems; Bank Independent of Sheffield, Alabama has said since using technology from Sageworks they have cut down time from a week to a day. Source.

The Competitive Enterprise Institute (CEI), a non-profit DC think tank that advocates on behalf of free markets, has published a paper on stablecoins as well...