The Consumer Financial Protection Bureau ended the first “no action letter” agreement with a fintech that had provided immunity from regulatory actions.

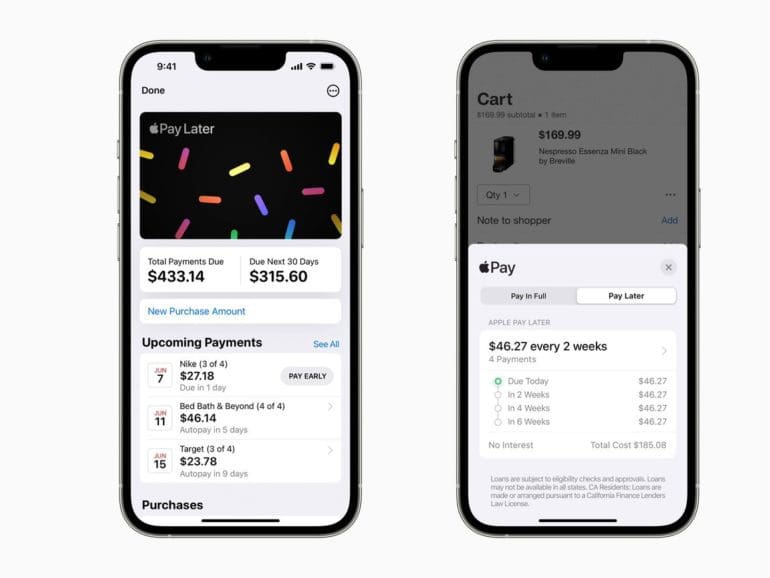

Apple Inc. will handle the lending itself for a new “buy now, pay later” offering, sidestepping partners as the tech giant pushes deeper into the financial services industry.

Mayor Adams said the city is leaning into blockchain and digital assets with their blockchain center in New York and blockchain week.

PayPal crypto chief Jose Fernandez da Ponte said plans to let users move their crypto holdings to third-party wallets have been in the works since 2021.

Bipartisan crypto overhaul seeks to treat most digital assets as commodities and empower CFTCView Reddit by CoHemperor - View Source...

John Collison, Stripe's president, said he's "pretty unapologetic" about decisions to launch similar features to rival fintech firms.

On the second day of the Fintech Nexus USA conference, Nubank's David Vélez recounted in direct terms the multi-year overnight success.

The bank founded by Morgan Stanley veteran Caitlin Long filed suit against the U.S. central bank for delaying a decision on its application for a master account.

In this episode, we talk with Sultan Meghji, the former head of innovation at the FDIC, about financial regulation and what it will take to truly modernize the banking system...

The Apple Pay Later product slams other BNPL players, but its affect on banking could be bigger, especially as part of a payments platform.