Consumer advocates and fintechs say the traditional credit score and lending systems that use it are murky and perpetuate bias. FICO’s leader points out that new FICO scores use expanded data sets, just as fintechs do.

Marlin Announces New Brand Identity to Reflect its Growth Strategy Bitbond – First German STO with security PeerStreet Named Among...

Small business lender Fundbox believes their new credit and payment product will help to solve the cash flow issue at small businesses; “We want to do for [small-business] B-to-B commerce what the entire credit card infrastructure has done for B-to-C commerce,” said Prashant Fuloria, chief operating officer of Fundbox, to American Banker; one of the biggest reasons for some of these issues is there is no credit scoring equivalent for small businesses; Fundbox Pay allows businesses to get paid immediately and gives those invoiced 60 days to pay at no charge, allowing businesses to handle the seasonal cash flow issues without too much pain. Source.

The public is already served well by private-sector tokens, the USDC stablecoin issuer said in a comment letter to the central bank.

The saga of embattled German fintech Wirecard has entered a predictable new phase; the digital payments company has filed for...

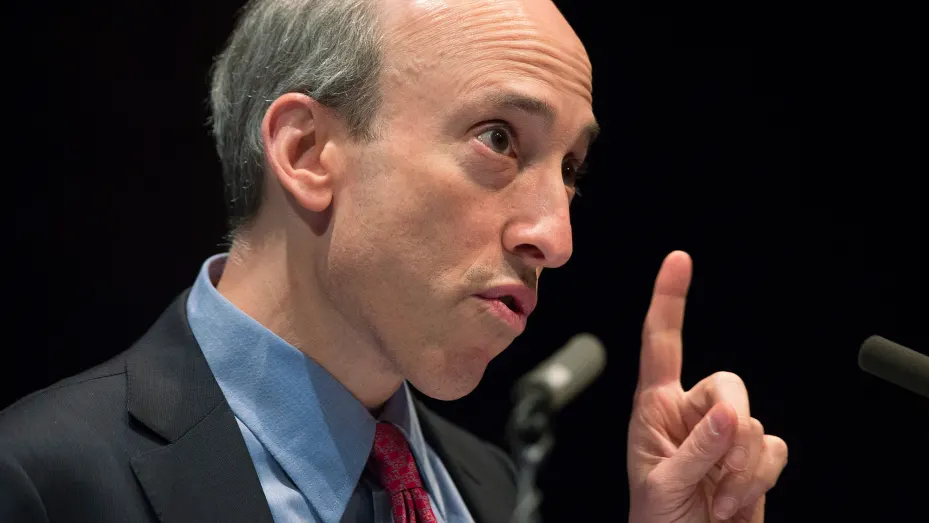

The SEC announced Tuesday that it is almost doubling its staff responsible for protecting investors in cryptocurrency markets.

LendIt Fintech USA 2020 is coming to your desktop on September 29 through October 1; it is everything that you...

With Fund III, Cathay Innovation launches what will surely be one of the largest multi-stage VC funds to emerge from Europe.

The move by Goldman Sachs into retail banking with Marcus has been a big shift for the bank and thus far has paid off; speaking to CNBC Goldman Sachs CEO Lloyd Blankfein talked about their move to consumer lending, their expansion of digital banking with Marcus and the focus on developing in house technology. Source.

Ernst & Young has released its EY Global Banking Outlook 2017 report which provides insight on incumbent bank investments; says approximately 60% plan to invest in new technologies and reports that banks have the highest priority on customer facing technology; the survey report includes data from approximately 300 banks across Europe, the Americas, Africa and Asia-Pacific. Source