We are living in times of extremes, particularly when it comes to economic data, and this is reflected in the...

With most of the large banks reporting earnings this week one trend has become clear; as the loan books have...

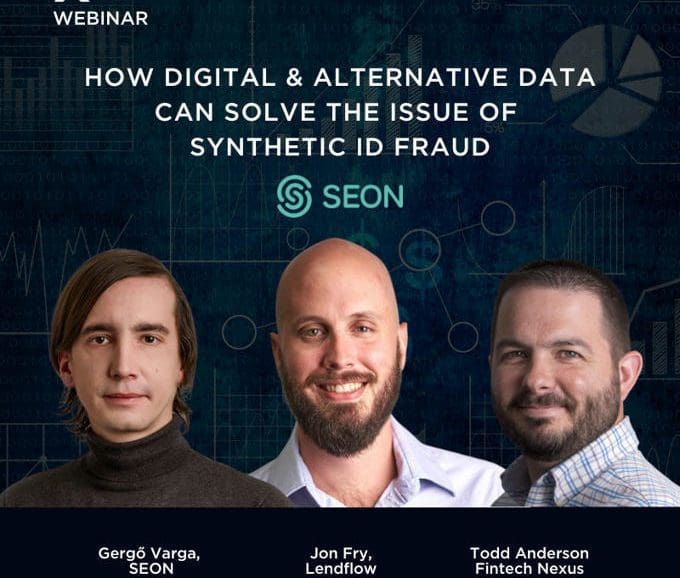

Synthetic identity fraud continues to develop into the fastest-growing type of financial crime in the U.S.

Synchrony (NYSE: SYF), a leading consumer financing company, today announced an expanded strategic partnership with Fiserv, Inc. (NASDAQ: FISV), a leading global provider of payments and financial services technology solutions.

Amazon's deal with Venmo has the potential to set a new standard for payment tenders in general, and other brands are likely to follow in its footsteps.

Despite the continuing bear market, consumer interest in crypto remains high. Plaid found that increased trust could be the key to adoption.

Dobot was launched in 2016 and was acquired by regional bank Fifth Third Bank last year; the app is designed...

SoFi CEO Anthony Noto was interviewed by Jim Cramer on CNBC’s Mad Money yesterday where he talked about the investing...

One of the key pieces to the new MIFID II regulations is more transparency around investment fees; robo advisors have made their products more transparent and less complex, seeing that traditional advisors are now forced to be more transparent robo advisors might begin seeing business headed their way; before MIFID II investors incurred costs which were not required to be disclosed for buying and selling of shares, taxes, custody, slippage and more; implementation has been slow as incumbents try to adjust to the new regulatory requirements. Source.

Payments giant Stripe cuts internal valuation amid broader market downturn for fintechs...