The OakNorth neobank+fintech model confirms that banking and technology are increasingly inseparable. It may prove to be a template.

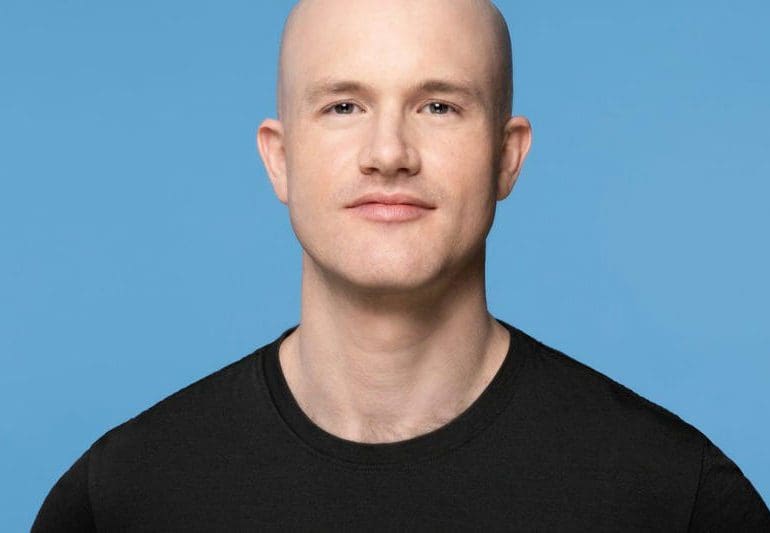

The first crypto company to join the list recorded revenue of over $7.8 billion in fiscal 2021 and placed 437th.

The U.S. Federal Reserve is considering whether to launch a CBDC like other nations, and bankers argue that’s a dangerous idea.

Venture capital fund, Kindred, has a community driven approach. Their "equitable venture" model and focus on founders is about to hit the fintech sector. Hard.

By 2026, BNPL payments are expected to account for almost a quarter of all global e-commerce transactions, according to Juniper Research.

Across the industry, subscription charges and membership fees for fintech services add up. Among consumers between the ages of 21 and 55, 40% subscribe to fintech services, with half spending $10 or more each month.

Making news this week was FTX expanding into stock trading, Plaid getting into identity verification, Klarna raising money at a lower valuation, Nubank adds 5.7 million new customers in Q1, Robinhood launching self-custodial wallets and more.

Caribou (formerly MotoRefi), a Washington, DC- and and Denver, CO-based auto fintech enabling people to take control of their car payments, closed $115 million in Series C funding round, which brings the valuation to $1.1 billion

The Y Combinator-backed seed startup comes out of stealth with $6.2 million in funding for its blockchain-based personal finance app

Gimi, in a partnership with ABN Amro, has released a financial literacy app for children and the effects could go beyond economic benefits.