SAN FRANCISCO & BROOKFIELD, Wis., May 04, 2022--Affirm (NASDAQ: AFRM), the payment network that empowers consumers and helps merchants drive growth, and Fiserv, a global provider of payments and financial services technology solutions, today announced a relationship that will make Affirm available to Fiserv enterprise merchant clients later this year. With this partnership, Affirm will become the first buy now pay later provider fully integrated to the Carat? operating system from Fiserv.

The company is introducing the new account by leveraging a bank partner; the account will pay 2% APY and will...

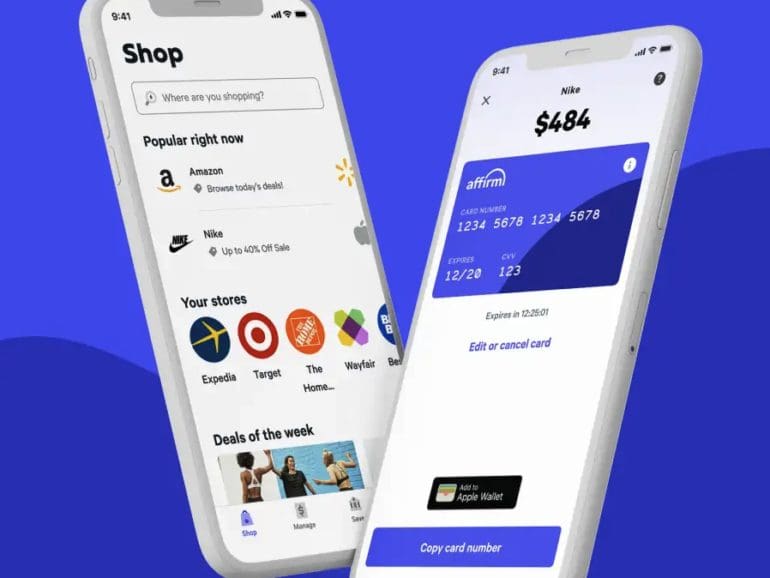

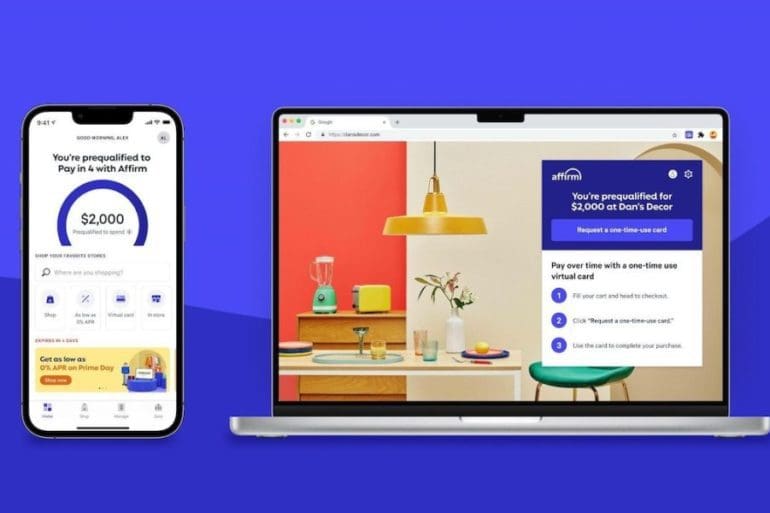

Affirm’s app has become a super app, the buy now, pay later (BNPL) network announced Wednesday (Jan. 26).

Consumer lending fintech Affirm (ticker: AFRM) went public on the Nasdaq Wednesday and saw their stock take off. Shares were...

Shares of fintech companies Affirm and SoFi soared Thursday after both companies posted their latest quarterly numbers

Affirm has dominated the market when it comes to point of sale finance at a time when consumers are increasingly...

While on the surface Affirm’s business may appear to be focused on lending and payments, the company can also help merchants in marketing; the company has large amounts of data on who is buying products, what they are buying and where they are buying; with this information they plan to offer their merchants more services in the future; Tearsheet shares more on Affirm’s plans. Source

While speaking on Business Insider’s podcast “Success! How I Did It” Affirm CEO Max Levchin shared the story about how he started PayPal; Levchin moved out to Silicon Valley after starting a business that didn’t succeed and was sleeping on his friend’s floor; he saw Peter Thiel deliver a lecture and stayed after to chat with the then hedge fund manager; they met the next morning for breakfast and Thiel liked one of his two ideas, he decided to invest and that was the company that became PayPal. Source.

After a difficult 2020 during which global investment plummeted due to the pandemic, 2021 emerged as a successful year for both public and private markets.

Nontraditional data is relevant across Africa as credit bureaus don't have the historical depth their Western counterparts enjoy.