China’s fintech market has been booming in recent years and now the industry has another concern regarding data privacy; Zhang Yi, chief executive of iiMedia Research, told the FT, “For the most part, these platforms aren’t selling data as their main business or they wouldn’t be able to survive. But employees who manage the data are the main source of data leaks.”; data is being sold on the black market and in most cases it comes from employees of the lender; most lenders say they sell data to third parties but the practice is opaque and not regulated very well. Source.

The highest court in China publishes information on their website of those who have failed to repay loans; debtors are unable to fly domestically, use the high speed train system or enroll their children in private schools; individuals also have a number of other restrictions; the ban works by linking a person’s ID number; the list launched in 2013. Source

According to a paper by the China Banking Regulatory Commission (CBRC) blockchain technology should be adopted by China’s secondary loan market; as CoinDesk reports the paper came out of a trip made by the regulator to their counterparts in the UK and France; European banks are putting together a program to test blockchain technology for the issuance of syndicated loans; the CBRC also considers blockchain technology to potentially be helpful for automating compliance. Source.

Central bank digital currencies have taken on more importance in the last few years with China leading the way as...

China’s central bank announced new regulations to curb risk in the asset management space; the new rules are an attempt to unify regulatory areas, prohibit asset managers from guaranteeing returns and have them set aside 10 percent for provisioning; “The central bank is trying to thread a very fine needle,” said Andrew Polk at Trivium China, a Beijing consultancy. Source.

Over the weekend China’s central bank stated that they will be gradually introducing a system of rules in order to...

Chinese commercial banks are beginning to see how much fintech can benefit them as they increase their spending and start...

While speaking at the Asian Financial Forum Jiang Yang, vice chairman of China's Securities Regulatory Commission (CSRC) said that fintech should serve the broader economy, not a select few; two markets mentioned in the talk included p2p lending and cryptocurrencies as they are two of the most popular areas of fintech in China; while Mr. Yang stated that fintech has provided more convenience they should not ignore risks like money laundering and financial crime; he also stated that regulators can play a key role to ensure these new tools are used properly and are widely adopted. Source.

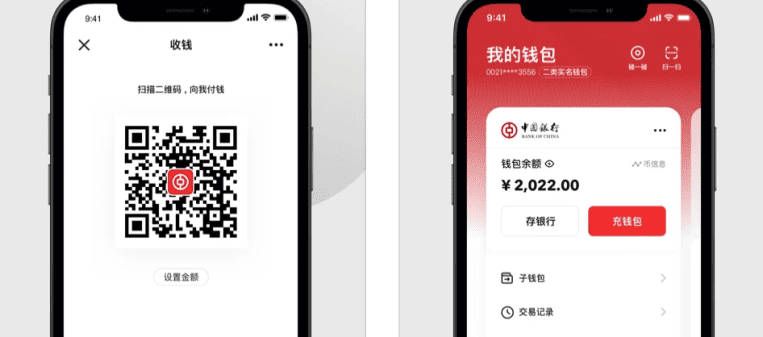

Tencent-owned WeChat, China’s largest messaging app and one of the country’s biggest payment services, will begin supporting the country’s sovereign...

One of the fastest-growing apps in China right now, by installs, is the central bank’s digital yuan wallet. 261 million individual users (as opposed to enterprises), about one-fifth of the population, have set up e-CNY wallets so far, and 87.5 billion yuan ($13.78 billion) worth of transactions has been made using the digital fiat currency, […]