After failing to win funding for a direct-lending program last year, Small Business Administration chief Isabella Casillas Guzman says the agency continues to study the option because banks and credit unions are making fewer small-dollar 7(a) loans than several years ago.

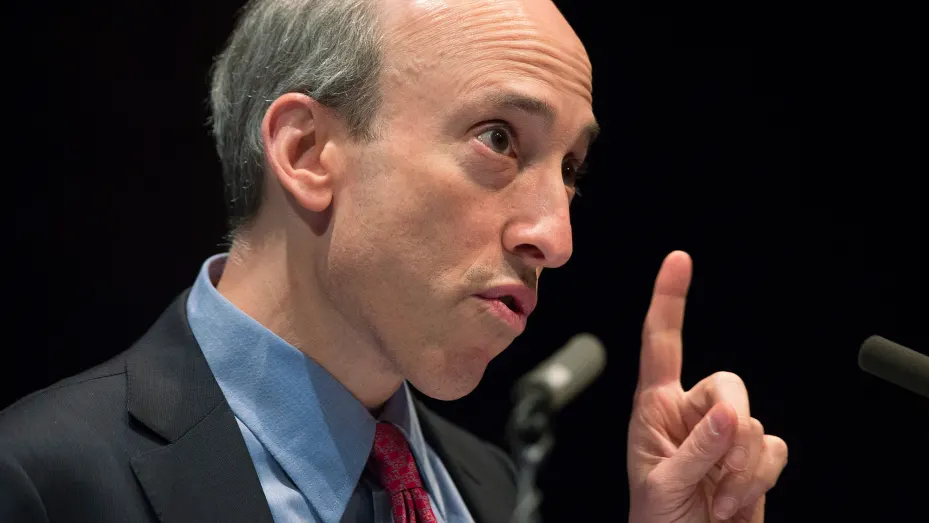

The SEC announced Tuesday that it is almost doubling its staff responsible for protecting investors in cryptocurrency markets.

Artificial Intelligence (AI) is becoming ever more integrated into the financial services sector, but how much further can it continue? Data, computing and social acceptance are some of the many reasons why its growth is being restricted.

Fireblocks Introduces DeFi Support For Terra, Allocates $250M In Liquidity Into Terra Web3 Ecosystem

Fireblocks, the provider of digital asset tech, recently announced that it has become the first platform to launch institutional DeFi access to Terra.

Jack Dorsey, bitcoin miners and others refute claims made by House Democrats who want the agency to investigate the environmental impacts of crypto mining.

Fidelity’s new metaverse learning center experience comes off as having been created by out-of-touch business execs trying to do something cool and hip—but failing miserably at it.

In this podcast interview Eyal Lifshitz, the CEO and founder of BlueVine, talks about building a small business banking platform and provides a contrarian view of embedded finance.

Making news this week was the CFPB director testifying before both the Senate and House, Fidelity will allow bitcoin in 401(k) plans, Robinhood had a bad week, the OCC is talking stablecoins, Goldman created a lending facility backed by bitcoin and more.

Money managers now want to pay banks to store and trade crypto for them.

The examples of both Dropp and Helium seem to indicate that there is real innovation in micropayment business models around shared ledgers and tokens, way out beyond the Bitcoin blockchain, cryptocurrency speculation and NFT madness.