In 2017 QuickFi Set out to bring innovative tech to equipment finance, a $1 trillion industry in the US stuck in the stone ages.

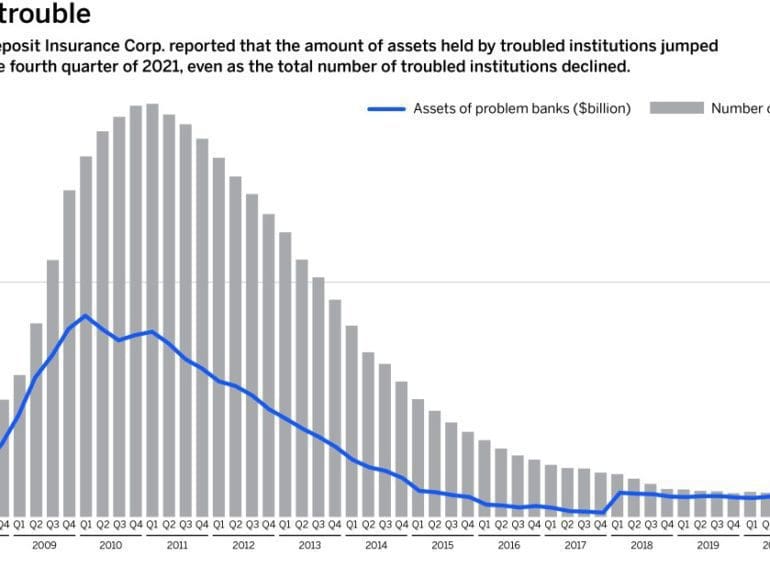

The Federal Deposit Insurance Corp. reported a spike in troubled assets, suggesting a fairly large bank may be under heightened scrutiny. But confidentiality rules make it impossible to confirm any details.

Intain team ran an audit of their platform, a blockchain structured finance ledger, and found $3.75 billion in assets live on the database.

The company has filed a lawsuit against the banking commissioner for threatening to end its partnership with a bank that enables consumer loans to exceed the state’s 36% interest rate cap. OppFi’s argument: Its bank partner is the true lender.

The White House is championing the case for digital assets with the President's Executive Order, and in doing so champions innovation, and blockchain’s compelling benefits to individual privacy, civil liberties, and participation in a more accessible democratic capitalism.

"Mello," LoanDepot's new unit, will put technology, lead generation, digital marketing, real estate and title insurance products in one division led by Zeenat Sidi.

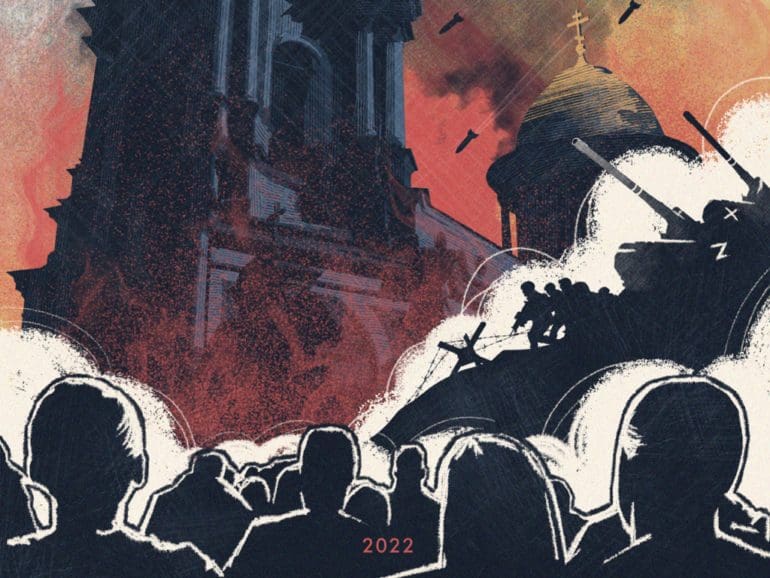

Fueling a renewed bull run, Ukraine used crypto to raise funds, while Russians bought crypto to evade their currency's collapse.

The bank's ongoing partnership with DailyPay complements services such as real-time billing and payments. This combination could help employers attract and retain employees amid the Great Resignation.

This BBC article … The remarkable items that have been used as currency … got me thinking about tokenisation. The article discusses the use of shells, specifically the seasnail shell called a cowrie, and how it became a global currency by around 1200BC. Although the cowrie is mainly found in …

A phenomenal increase on the £1bn price tag that Lendable reached in March 2021.