While more people are interested in crypto, most prefer to hold them within a bank, the results of a new survey show.

Interest in BaaS is surging, fueled by 'embedded banking' and by tech company enablers. All that is also bringing increased focus on risk.

PayPal has 426 million accounts registered on its platform, acquiring 120 million of those within the last two years. With the emergence of new payment methods and processors, the firm has been going through a phase of slowing growth.

The bank updated its targets for return on tangible common equity, consumer banking revenue and asset management in a less splashier fashion than its 2020 investor day.

Amazon has agreed to accept Visa cards across its global network, settling a feud that threatened to damage the financial giant’s business and disrupt e-commerce payments.

The tax preparer has a well-recognized brand and wide reach, but needs tech help for its neobank.

Revolut’s ambition to provide a one-stoop-shop for business banking services has been given a boost with the introduction of integrated...

Some of the biggest players in crypto – including BlockFi, Coinbase and Robinhood – have joined forces to develop technology...

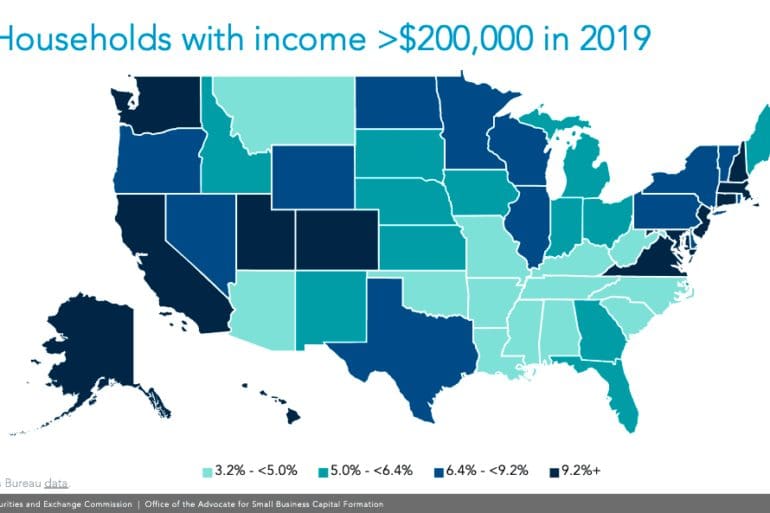

SEC Report Shows Why Accredited Investor Definition Should be Adjusted to Provide Access to More Investors. | Crowdfund Insider: Global Fintech News,

DeFi holds out the promise of doing most of the things that financial institutions do – earning interest, borrowing, lending, buying insurance, trading assets – but doing it faster, without intermediaries, paperwork, and bankers. Institutions hold the keys to the mainstream adoption of DeFi.