New York-based banking service provider MANTL launched a Business Account Opening service that automates up to 97% of new account decisions.

One of the many benefits that fintech has brought is the democratization of investing. What initially attracted me to fintech was the ability to invest in consumer loans through LendingClub, an asset class previously unavailable to individual investors. Another asset class that has been unavailable to regular investors is collectibles. Want to invest in a classic car, rare baseball cards, books, coins or wine? You typically had to be wealthy. Our next guest on the Fintech One-on-One podcast is George […]

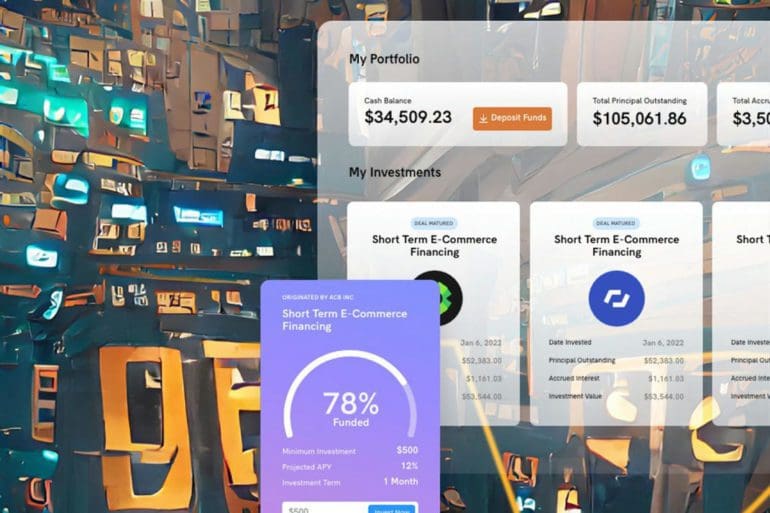

Taking on the $9 trillion private credit market, Percent launched a platform to help anyone underwrite in the private credit space.

Cryptocurrency exchange FTX saw its valuation swell to $32 billion in a new funding round announced Monday, highlighting continued appetite...

"There are disturbing echoes of the subprime crash" in the cryptocurrency market, Nobel Prize-winning economist Paul Krugman says.

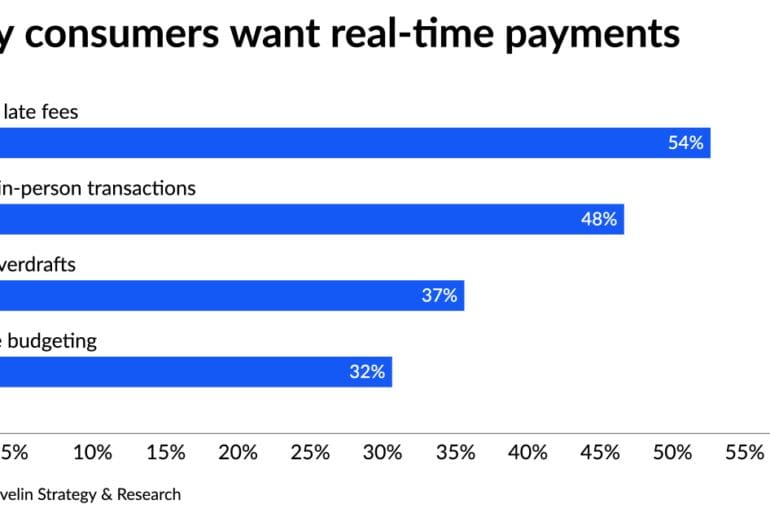

The Federal Reserve today announced the anticipated pricing approach for its FedNow Service for instant payments. Read the full article...

Genesis Publishes Q4 Report on Digital Assets: Crypto Lending Tops $50 Billion. | Crowdfund Insider: Global Fintech News, including Crowdfunding, Blockchain

China has designated some cities and entities to trial blockchain applications, underscoring the importance Beijing is attaching to this particular...

Crypto enthusiasts don’t only dream of revolutionizing the world of money. They want to reinvent the World Wide Web. That vision, which goes by the name of “Web3,” is of a decentralized environment built on crypto technology in which swarms of collaborators take back control of the web from giant tech companies. It’s a threat that those tech firms -- including Facebook owner Meta Platforms Inc. and Twitter Inc. -- are starting to take seriously.

Few banks have adopted an instant invoicing technology called Request for Pay, but more may get on board to help their customers avoid overdraft charges.