Walmart's fintech startup Hazel is to acquire earned wage access firm Even and neobanking ONE as it prepares to emerge from stealth mode.

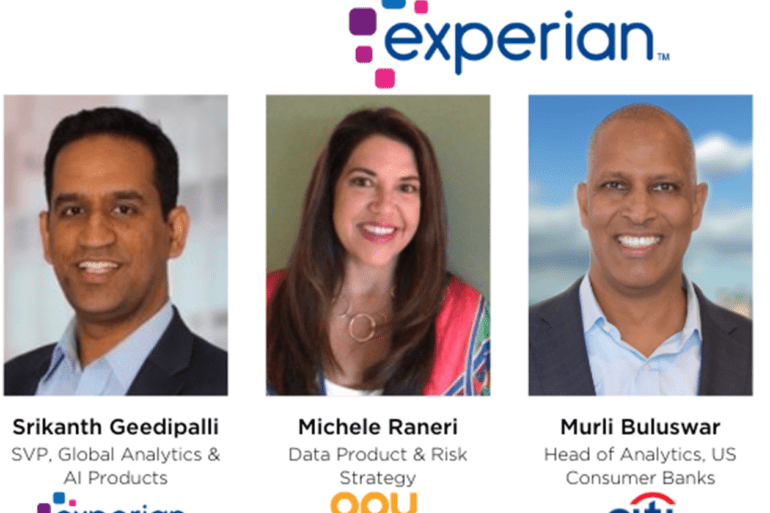

In the biggest webinar of the new year, three credit experts went live Thursday in front of the LendIt audience to talk about the future of AI analytics in credit.

Poor experiences paying healthcare bills drove two company founders to come together to make it simple for consumers to manage expenses.

Apple Inc. is planning a new service that will let small businesses accept payments directly on their iPhones without any extra hardware, according to people with knowledge of the matter.

Nearly a full year after purchasing RadiusBank, LendingClub boasted revenue of $262.2M and diluted earnings per share of $0.27.

In episode 36 I talk with Jordan Wright of Atomic Financial, the trusted way for people to connect their payroll accounts to an app.

This panel will explore the opportunities, challenges, and trends shaping today’s POS landscape.

A bank that relies on consumer service charges for 35.4% of its annual revenue gives customers a grace period to get their account balance less than $12 in the red.

Kafene’s financing platform allows consumers to access funds to purchase appliances, electronics, furniture, and other goods at participating retailers across the U.S. The company’s mission is to extend credit-like services for people to build credit on flexible terms without creating debt, as...

The $1.4 billion price tag for the UBS-Wealthfront deal matters because it could impact exit values for not only other startups but also hundreds of millions of dollars of invested venture capital.