FTX US will serve as the exclusive partner for any crypto offerings offered by Dave.

Don't worry, we speak : Español (Spanish), too!Bitso’s plans in recent days have included the generation of alliances that seek to promote information on the use of cryptocurrencies. First, the crypto exchange platform became an official sponsor of the Mexican Soccer Team. This was done in order to “inspire and teach Mexicans the proper use...

Credit Suisse has taken a majority stake in the startup TradePlus24 in a Series A-1 financing round; TradePlus24 is based in Zurich and helps SMEs increase their working capital by leveraging their domestic and export receivables; Credit Suisse recently announced a $200 million revolving credit facility with Kabbage. Source

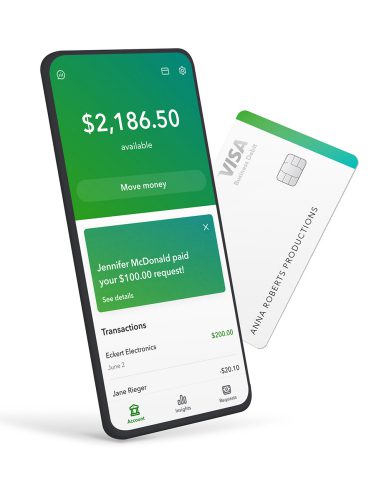

Intuit (Nasdaq: INTU) today announced Money by QuickBooks, the latest addition to a comprehensive and ever-expanding suite of QuickBooks offerings that power small businesses with the ability to get paid and manage their cash flow.

According to McKinsey $10 trillion is sent across borders by consumers and small businesses every year; however it is an...

European Banks have increased advertising for IT and engineering roles by more than 10 times in the last 3 years;...

Meet Glint, a fintech with an app and debit card that enables users to save, exchange, and spend in physical gold and multiple currencies...

The real time payments network Zelle has added new tech partners to their growing network; partners include ACI Worldwide, CGI, D3 Banking Technology and IBM; the new partners will help to accelerate technology, reduce risk and control costs for Zelle as their payments network grows over time. Source.

Small business expense monitoring startup Digits is launching after two years in stealth mode; the company has raised a $22mn...

Banks have historically made money on overdraft fees, out-of-network ATM fees, fees for not maintaining a certain minimum balance and more; this fee structure has helped give banks a bad name; big tech companies and fintech startups have garnered a better reputation for upfront fees for a simple service and transparency around other fees; “It’s important to let consumers understand what you’re offering, what the fee structure is — and be abundantly clear about it — and then you can build trust,” said Jay Shah, CEO of Personal Capital to TearSheet; studies show that customers are not turned off by fees, but are annoyed when they hear of free checking then see ACH transaction fees or overdraft fees; banks need to begin to understand what their customers want and how much they are willing to pay for it in a clear way. Source.