American Express' Pay It Plan It mobile feature allows for installment payments on purchases of over $100; the mobile feature is associated with a customer's American Express card; the company says Pay It Plan It is available now on several consumer credit and co-branded cards and cards issued after June 1 will have the feature added by 2018. Source

American Express is looking to use the same style data that has made PayPal and Square so successful in small business lending; Gina Taylor Cotter, senior vice president and general manager of global commercial financing at American Express. tells American Banker,“We have done some research on this and we are trusted providers, so this puts us neatly between banks that may have a longer application process and the online lenders who are fast, but maybe a bit more expensive." Source.

American Express has historically focused on building their own products but the firm is now open to more partnerships to...

A small group of American Express salespeople pushed credit cards on small business owners without adequate credit checks or through...

To increase its share of global card spending through gig-economy fintechs and startups, Amex is extending its rewards through a partnership with digital issuing vendor i2c.

Credit card companies are seeking to push further into the “buy now, pay later” (BNPL) market. American Express (Amex) announced today that it plans to partner with Opy, the U.S. subsidiary of Australian fintech Openpay, to allow all of its U.S. cardmembers to pay in installments for qualifying purchases in the healthcare and automotive segments....

The companies' moves came a day after Visa and Mastercard said they were halting business in Russia because of its attack on Ukraine.

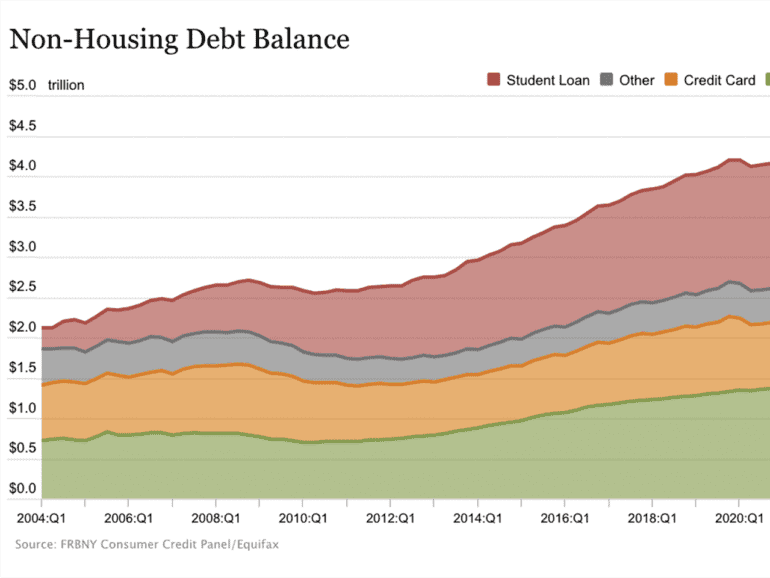

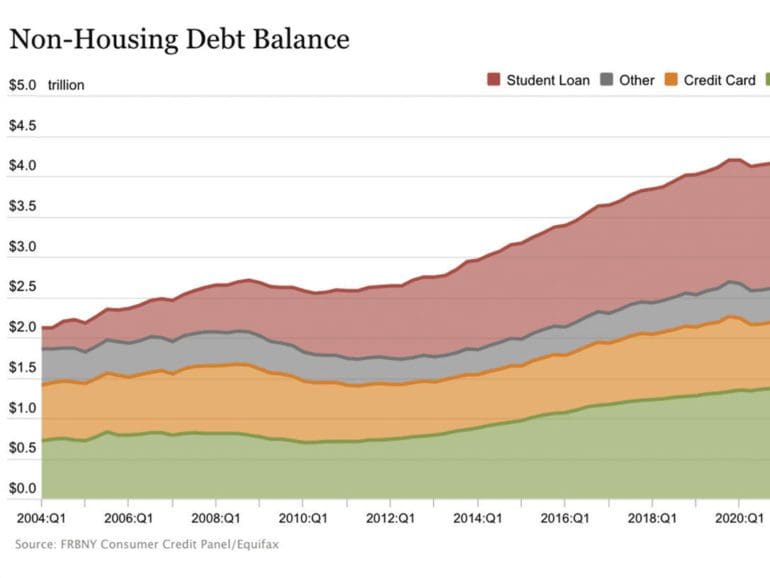

A New York Fed report shows Americans leaned heavily on their credit cards in June to offset growing financial pressures from inflation.

A New York Fed report shows Americans leaned heavily on their credit cards in June to offset growing financial pressures from inflation.

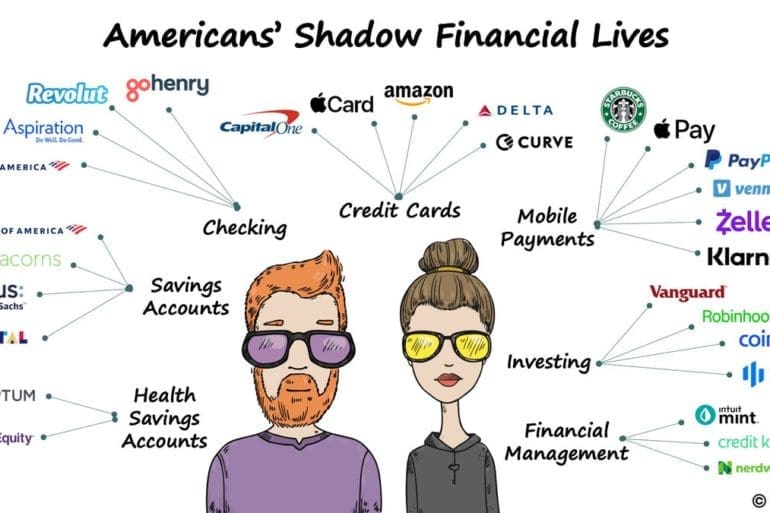

It’s not uncommon for today's Gen Zers and Millennials to do business with 30 to 40 financial providers. The irony and new reality of this: In our quest for more convenience in our financial lives, our financial lives have become more complex to manage.