MarketInvoice inked another bank deal with Varengold Bank AG for £45mn ($60mn) in debt funding; according to AltFi MarketInvoice's capacity to take on institutional money has increased four fold since 2014; MarketInvoice have funded over 70,000 invoices and lent out over £1.5bn ($2bn). Source.

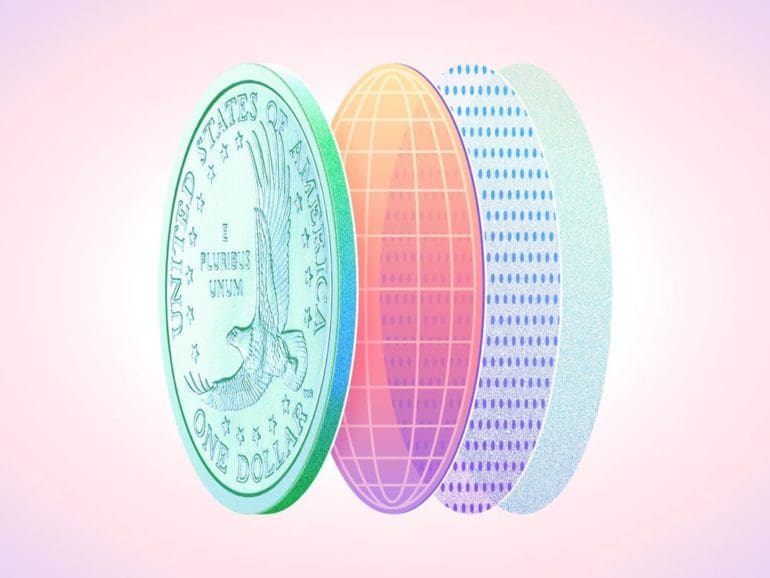

Crypto is poised to transform payments, says Circle CEO Jeremy Allaire, and the stablecoin maker behind USDC wants to be at the heart of this future.

Druo's technology creates an ecosystem that enables B2B users to charge or pay directly to any bank account without having to go through the complex network of financial intermediaries.

·

“We see stablecoin not as a token at rest. We see it as a token on the move. So our...

The Linux Foundation has agreed to acquire the Fintech Open Source Foundation (FINOS) and will allow the group to operate...

Competitors have added users since the world’s largest stablecoin briefly broke from its $1 peg in mid-May.

The Merchants Payments Coalition is calling on US politicians to block Visa and Mastercard interchange fee hikes that are set...

While venting to CoinDesk about unflattering Reuters coverage, the crypto exchange’s investigations team shared insights about the scale of illicit activity at Binance and its crime-fighting methods.

Off the recent news about Stripe's fundraising round, payment companies across the board are seeing growth and increased investor interest; Adyen BV, WePay, PayPal and Square are just a few of the other, well positioned names who are benefiting from the sector wide growth; Square's stock price rose on news of the Stripe fundraising; as online lenders have struggled, payment firms have only continued a pattern of growth, even more evident by the recent holiday sales numbers that showed 109 million people shopped online, more than the 99 million who went to the stores. Source

American Banker shares their takeaways from their recent conference after hearing from a wide variety of thought leaders in fintech; takeaways include: mobile and mortgages go together, don’t count out banks, the need for simplicity is paramount, small businesses care about digital too and the fintech charter is meh. Source