2TM wants to enter Chile, Colombia, Mexico, and Argentina through strategic acquisitions.

Mexico is one of the fastest-growing economies in the world, but its local businesses still struggle to access credit without super-high fees and tedious paperwork. Mastercard (NYSE: MA) and Jeeves, the financial partner for Mexican businesses, have teamed up to address this issue by introducing

Open banking presents new capabilities for business lenders. One of the most notable: Secure, immediate access to financial insights using automation. As data availability and technology advances, bank and non-bank lenders must improve how they assess credit worthiness.

TikTok creators in some parts of the world will now be eligible to receive direct tips from viewers.

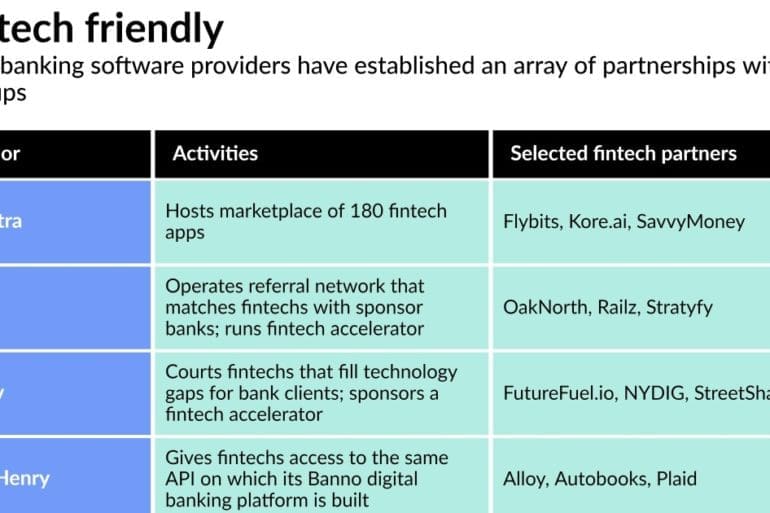

Fiserv, FIS, Jack Henry and Finastra, the top U.S. core banking software providers, are stepping up efforts to let banks plug innovative technology from younger fintechs into their legacy systems.

"Financial institutions that have a higher share of frequent overdrafters or a higher average fee burden for overdrafting should expect us to be paying them close supervisory attention," bureau Director Rohit Chopra said.

Through the partnership, companies will be able to launch credit cards using Marqeta's open APIs, while embedding within their app ecosystem.

Financial education is one of the best investments in our children’s future

The gig economy may be flourishing, but its rapid expansion is also giving rise to new challenges related to cross-border payments that businesses and employers must overcome so they can continue to onboard competitive global talent and avoid high turnover.

During the pandemic, startups like Chime have posted astounding growth in users and valuations. So why are some car rental companies, hotels and other big vendors wary?