Over the last year, banks and venture capitalists have poured tens of millions of dollars into technology to fight financial...

Lydia, a Paris-based financial services app, has raised over $100 million in new funding, taking its valuation above $1 billion.

The new express branches are meant to help customers with routine transactions like withdrawals and deposits; customers looking for further advice or a loan would be able to connect via videoconference or go to a typical branch; they are looking to serve millennials in a more efficient way and allow them to access bankers and wealth managers through a digital experience using iPads; removing some of the human intensive areas of the bank and making it more self serve will cut down on costs and help to serve the younger, digital customers. Source.

Some banks have recently started automatically increasing credit card limits for customers; the credit card companies hope that doing so...

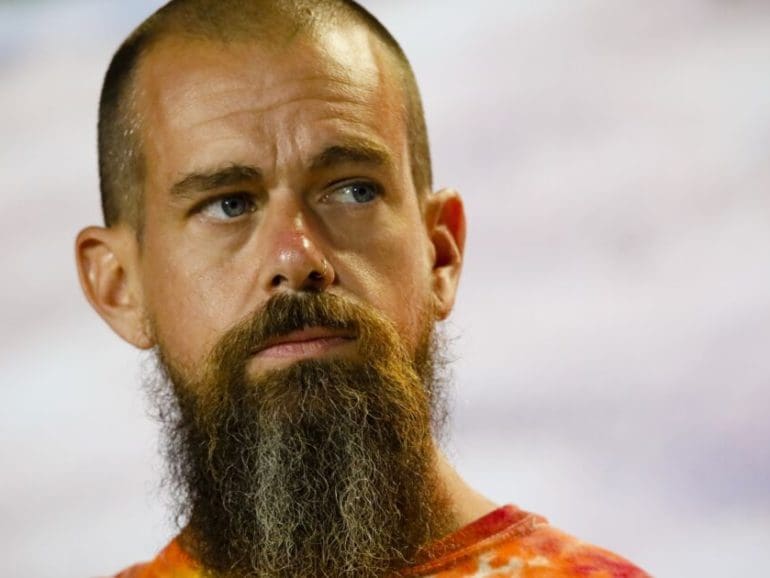

Block, the digital payments firm run by Jack Dorsey, reported strong quarterly sales that were in line with expectations but failed to impress investors.

I tweeted the other day that my bank received a refund from a retailer but, due to the account being in GBP (UK) and the retailer trading in z? (Poland), the refund lost a lot of value. Over £170 to be exact on a purchase that was for over £2,500. …

Former Goldman Sachs banker Mona El Isa has founded an asset management services company that will provide blockchain solutions for hedge funds; El Isa launched Melonport in February 2016 with co-founder Reto Trinkler and has now hired George Hallam, former head of external communications at the Ethereum Foundation; El Isa's hedge fund services will use smart contracts to automate various aspects of portfolio management for hedge fund managers which will lower the costs of building a hedge fund. Source

Apple and Goldman Sachs have partnered on a new credit card which will include iPhone features to help people manage...

After Apple shook up the Buy Now, Pay Later market with news that it would now be a competitor to established firms, PayPal this morning is introducing another buy now, pay later product to follow the 2020 launch of its “Pay in 4? installment program.

China-based Qudian said on Monday it has filed with the SEC to raise up to $750 million in an initial public offering, planning to to list on the NYSE under the symbol QD; Qudian plans to use net proceeds for strategic acquisitions and marketing and borrower engagement; Qulian provides small loans and installment-based financing for e-commerce in China. Source