This headline caught my attention the other day: Bank loyalty costs savers £1.6 billion a year in missed interest The detail: There’s £246.5 billion ($340 billion) languishing in accounts paying no interest at all … A survey of 2,000 adults across the UK, with 42 percent of respondents stating that …

Financial institutions have only begun to scratch the surface of how VR and AR may be used for customer interaction as well as staff training.

The incoming mayor of New York City thinks that schools should add cryptocurrency and blockchain technology to the curriculum, as Eric Adams ups the ante in his plan to transform the city into a crypto hotspot.

A recent report from banking regulators says the digital assets pose too big a risk to the financial system to be issued by state-chartered entities that don’t have deposit insurance. Stablecoin issuers and others reject that claim and say regulators are discouraging competition.

PayPal (NASDAQ:PYPL) has announced its Q3 earnings results with an EPS beat of $1.11 (non-GAAP) and total payment volume of $310 billion and 416 million accounts. Net revenues were reported at $6.18 billion an increase of 13% versus year prior and net income arrived at

Ocrolus, a financial document automation provider, and end-to-end cloud-based lending platform Blend, announced a strategic partnership which will embed Human-in-the-Loop (HITL) document analysis into Blend's digital mortgage applications, according to a press release.

Monument Bank, a digital banking startup targeting affluent professionals, is cleared to launch in the UK following the Financial Conduct Authority removing regulatory restrictions from the neobank, according to a press release.

The bank is partnering with Anthemis to match investors with female entrepreneurs, who according to Findexable research attract just 1.5% of investment in the sector.

Overdraft fees are criticized as unfair penalties for lower-income customers, but they are often better for consumers than getting purchases rejected.

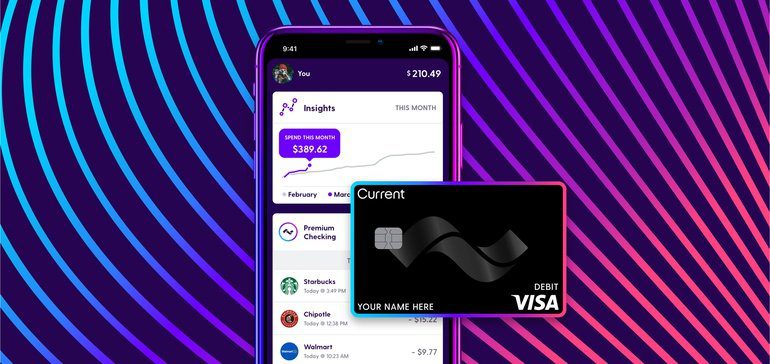

Curbing the need for a third-party processor helps money move faster, said the fintech's CTO, Trevor Marshall. "When I think of a checking account, I think of a parking lot," he said. "Current is about movement."