Shoppers are all set to head back to physical stores this holiday season. Klarna’s 2021 Holidays Unwrapped report finds that 30% of consumers plan to shop primarily in-store, while 27% want to do a mix of online and in-store shopping.

This week saw three fintech firms representing payments, debit, and credit post results. Although each saw momentous growth year over year, in some cases, it was not enough to outpace expectations after this bull run of a year for fintech.

Backed by Tim Draper and other investors, the fund is aimed at LatAm founders anywhere that are working in industries like biotech and crypto.

The new office will serve as its first in Europe and will be operational in March, initially staffing up to 50 by the end of next year.

Latam Fintech PayU says it will hit $8 billion and 300 million transactions in 2021. PayU says it has experienced an 80% user growth since 2019. PayU is a is the payments and Fintech business of Prosus and a leading online payment service provider, operating

The acquisition will help the Argentinean unicorn to become a solid fintech competitor in Mexico.

'If well-designed and appropriately regulated, stablecoins could support faster, more efficient, and more inclusive payments options.'

Please clicRecent ‘unicorns’ like Brex, Paxos, and Chime are unique in that their innovation extends to internal functions, like risk management. This survey aims to identify the connection between innovative risk management and business growth. Could a dynamic approach to handling risk actually accelerate progress?k the link to complete this form.

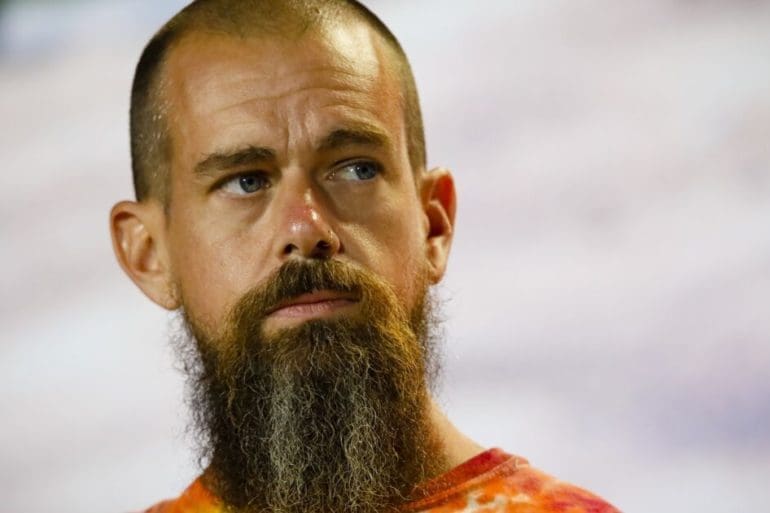

Jack Dorsey's payments company wants to reach a younger demographic while also giving adults more reasons to use its peer-to-peer service.

Latam Fintech PayU says it will hit $8 billion and 300 million transactions in 2021. PayU says it has experienced an 80% user growth since 2019. PayU is a is the payments and Fintech business of Prosus and a leading online payment service provider, operating