Portugal based BNI Europa has formed a partnership with German software firm NDGIT to expand their open banking offering across...

Fifth Third Bank has struck a partnership with fintech Fundation to offer small business loans and lines of credit; Fifth...

The Spanish lender is going through a digital transformation as it looks to better serve their customers; through the five...

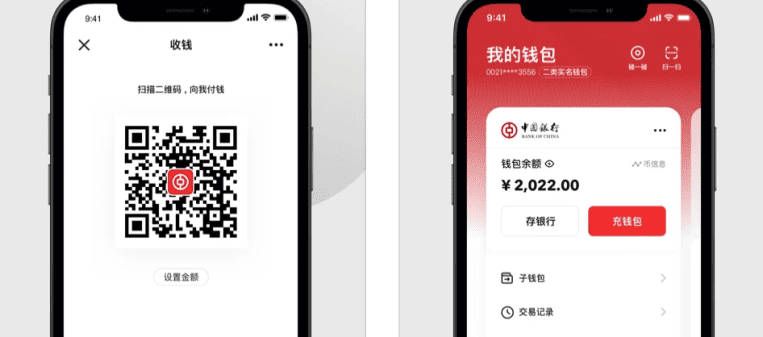

One of the fastest-growing apps in China right now, by installs, is the central bank’s digital yuan wallet. 261 million individual users (as opposed to enterprises), about one-fifth of the population, have set up e-CNY wallets so far, and 87.5 billion yuan ($13.78 billion) worth of transactions has been made using the digital fiat currency, […]

This is the age of the great customer experience. Online shopping has forged ahead, and many in-store retailers are struggling to catch up. Does technology provide the answer? We consider the future of in-store shopping and the point of sale.

The Office of the Comptroller of the Currency (OCC) has introduced a new initiative to promote greater financial inclusion amongst...

At LendIt's Lang Di Fintech conference this July in Shanghai, Up Financial CEO Steven Yuan talked about the power of big data and artificial intelligence for the economy; he calls this intelligent finance and believes that using these tools will allow for investing to come to the masses; he also thinks that the tools can help to lift up the broader economy; he points to a report by Boston Consulting Group about China's private investable assets in the next three years and believes there is an enormous opportunity to leverage wealth management; Up Financial's goal is to create a personalized new financial system for individual investors and big data plus artificial intelligence will allow for them to potentially reach these goals. Source

Credit Karma CEO Ken Lin talked with Business Insider about the current crisis and what the company is doing to...

Credit bureaus in the US have become integrated with fintech companies in different ways; Forbes talks with Alex Lintner about Experian's business initiatives and the solutions the company is providing for the fintech industry; Alex says the company is focused on digital technology solutions for credit data that help improve the loan application for consumers; Lintner also notes the availability of full file reporting which can meet the growing demand for alternative credit underwriting and the company's development of APIs for startup businesses. Source

Puneet Singhvi will become the head of digital assets for Citi's institutional clients group Dec. 1, according to an internal memo.