For too long small businesses have suffered a lack of access to capital. Now, banks and fintechs are in a unique position to combine their strength to help provide financing in underserved communities

Just a few years ago, Banking as a Service (BaaS) was a term hardly ever heard in Latin America outside...

The fintech community's one-stop-shop for all things lending and digital banking. Conferences, podcasts, news, webinars, & white papers showcasing the latest in fintech.

As communities across the country are hit by the coronavirus some banks are stepping in to help; in Seattle some...

Buy now, pay later's stellar growth shows the importance of customer experience in today's banking battleground, writes Alexa Guenoun Chief Operating Officer at Temenos.

Banks that rely on: 1) branches to attract and sell; 2) geography to determine who to sell to; and 3) customer experience to differentiate won’t produce acceptable levels of growth and return on assets.

Banks are feeling the hurt like everyone else and they need to operate in a new reality; many have started...

Investing has never been more accessible, and banks and credit unions are losing deposits (and relationships) to investing fintech startups.

According to a study by Banking on Climate Chaos, the world’s 60 largest commercial and investment banks lent a total of $3.8 trillion in fossil fuels from 2016 – 2020. JPMorgan Chase headed the charts as the world’s top banker of fossil fuels, lending $317 billion in the five-year period.

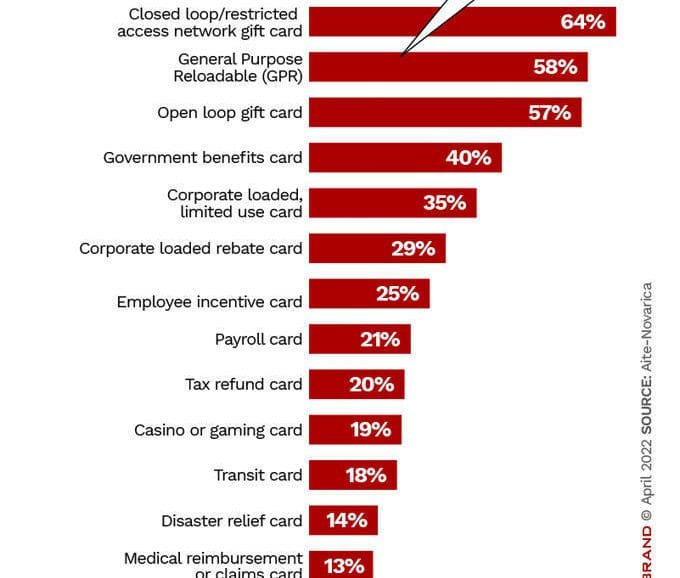

Banks often regard prepaid cards as high risk/low reward. In fact, prepaid technology is now being used to create digital products quickly.