Tala CEO Shivani Siroya not only points to the idea of building trust to grow a customer base but also belief in her instincts.

The Consumer Financial Protection Bureau has opened an inquiry into whether the largest issuers are engaging in unfair or anti-competitive practices. JPMorgan Chase, Citigroup and the rest of the top eight control 70% of the $1 trillion credit card market.

The Fed looks to supervise banks' involvement in crypto and fintech. Innovation is the focus but their approach will determine if successful.

At a panel at The Economist Finance Disrupted conference held in London, three out of four venture capitalists mentioned insurance as an area of most interest to them according to Business Insider; Timo Dreger, managing director at Apeiron Investment Group stated: "Right now we are looking at insurtech. It's for sure the hottest thing in 2016 and for sure the hottest thing this year too. The answer is pretty easy why. In the whole insurance industry, there's a lack of innovation and the user experience is pretty horrible."; while there has been a lot of innovation in the US, there are several notable insurtech startups across Europe; in the US, Oscar, an online health insurance company has raised $700 million. Source

The World Economic Forum in collaboration with The European Sting puts forward the interesting idea that the impact of fintech...

CU Ledger is a consortium of credit unions which is now testing out IBM’s Hyperledger Fabric solution; according to Coindesk,...

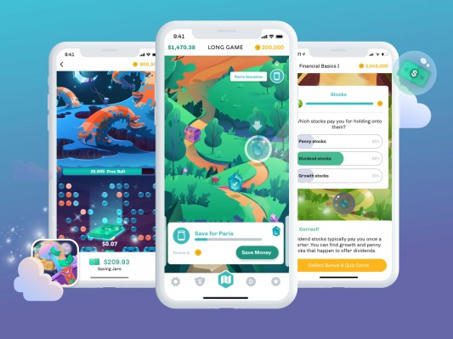

Truist acquires fintech startup Long Game in effort to reach younger demographic...

A new survey by Promotory Interfinancial Network of 543 senior bank executives showed that their number one fear is the...

Varo Money CEO Colin Walsh : We Designed Varo to be Your Primary Bank Account Square acquires European peer-to-peer payment...

By the end of 2022, JP Morgan Chase hopes to cover 93% of Americans via their branch network; this amounts...