By the end of 2020, the Central Bank of Brazil launched its own instant payment system, called PIX, with the ambitious goal of speeding up and facilitating transactions.

The fintech community's one-stop-shop for all things lending and digital banking. Conferences, podcasts, news, webinars, & white papers showcasing the latest in fintech.

In 2017 QuickFi Set out to bring innovative tech to equipment finance, a $1 trillion industry in the US stuck in the stone ages.

In 2017 QuickFi Set out to bring innovative tech to equipment finance, a $1 trillion industry in the US stuck in the stone ages.

·

Fintech Nexus interviewed Ramp co-founder and CEO Eric Glyman, who believes it should be robots chasing corporate expense receipts, not...

Success with the bank's 'NOMI' app showcases the future of retail banking through the predictive use of artificial intelligence.

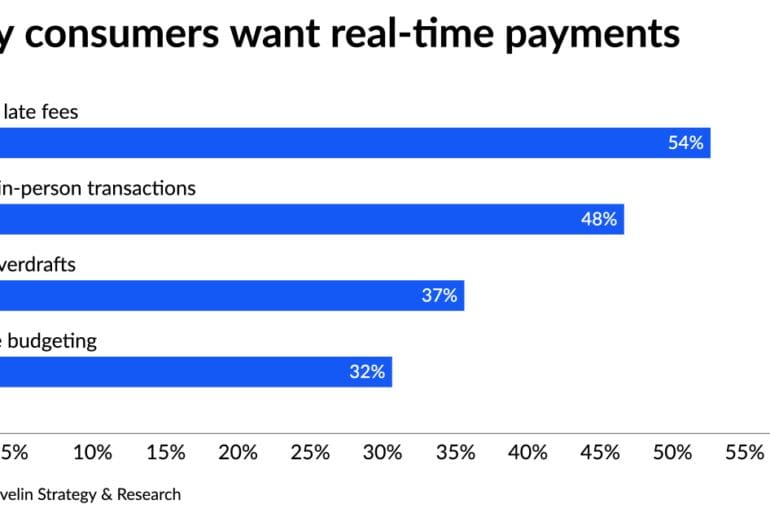

Few banks have adopted an instant invoicing technology called Request for Pay, but more may get on board to help their customers avoid overdraft charges.

I like the guys at Ant Group. I like what they are doing with tech. This was featured heavily in Digital Human, and the company have continued to innovate ever since, most recently with AntChain. AntChain promotes the use of blockchain and have found several sweet spots for this technology that …

In 2011 Regions Bank started studying their customers usage of social media and how that might effect the bank’s interaction and understanding of them; they found household revenue of customers active on social media was 60 percent higher and household deposits of social media users was 76 percent higher than non social users; the bank has a social strategy that focuses on increasing loyalty, delivering customer service but most importantly driving revenue; Tearsheet interviewed Melissa Musgrove, head of social media at Regions Bank, about how they have evolved since 2011 with their approach to social media; they also discussed challenges faced inside the bank, what drives revenue and what keeps Melissa up at night. Source.

As installment lending becomes more popular, regulators in the U.S., Europe and Australia are considering new restrictions or taking action against lenders.