IEX came on the scene a few years ago with a lot of excitement with CEO Brad Katsuyama gaining fame...

DeFi is beginning to expand beyond a niche market. The high interest available via saving and lending products, and multiple investment opportunities have begun to motivate people to enter the space. While the 2010s will be remembered as the decade where decentralized finance was born and...

In part two of the series written about decentralized lending Jason Jones asked John Donovan (co-founder and former Lending Club...

·

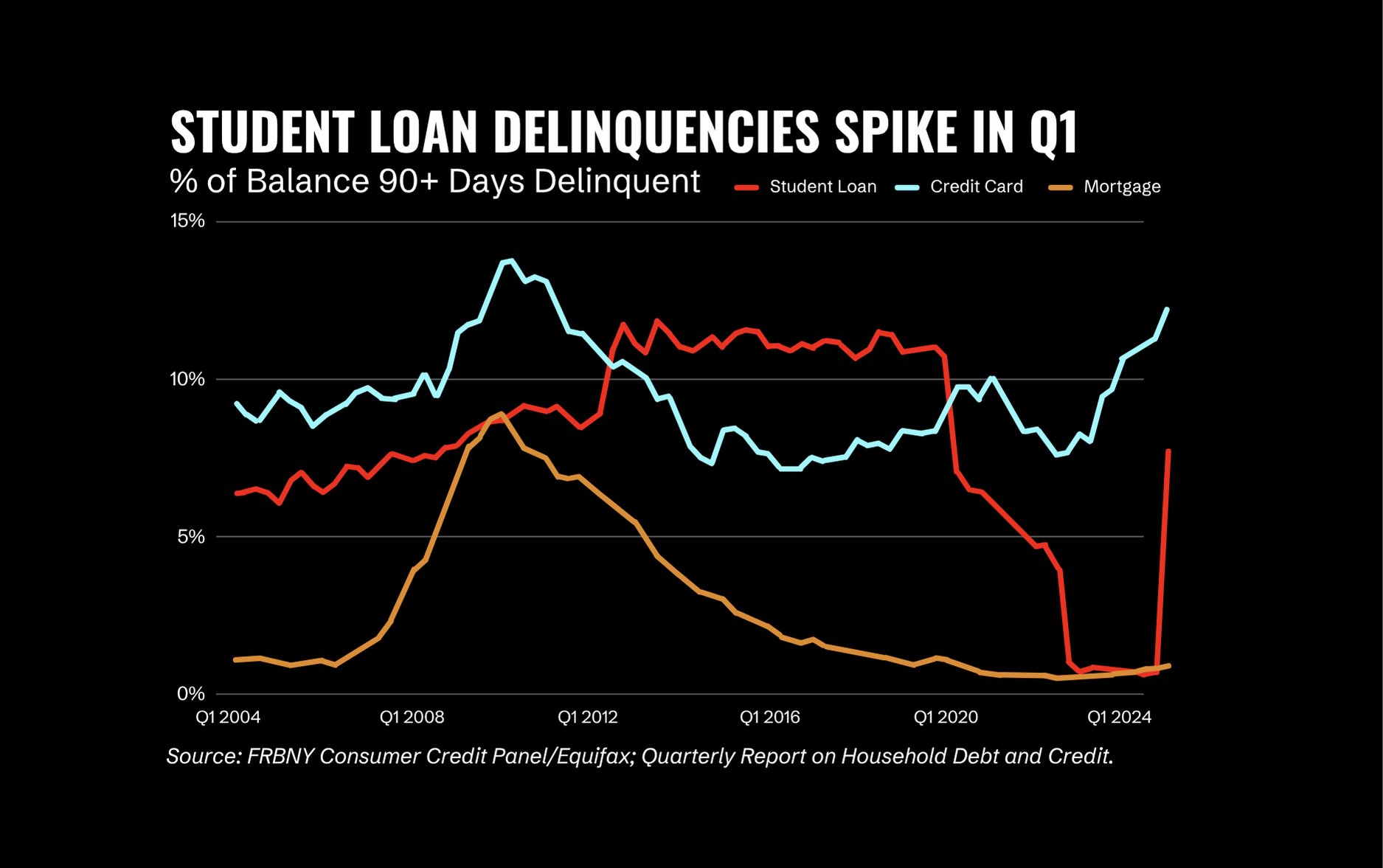

$250 billion in now-delinquent debt is hanging over millions of consumers as the Trump administration’s policy changes may mean a...

If this crypto crash is like the tulip bubble then that is a very good thing, because the new regulatory environment that will support tokens, digital currencies and decentralised finance will be the crucial factor in creating a new golden age whether Bitcoin goes to zero or $100K next year.

To create a memorable brand you should start early and be consistent. With these tips you do not need a big budget to create a winning fintech brand.

Talking about censorship resistance isn't enough. Web3 proponents should use the applications they advocate for.

UK crowdfunding platform Crowd2Fund has reported year-over-year transaction growth of 4,700%; in Q1 2017 it provided funding to a range of industries with the number of businesses receiving funding increasing by 3,900% in comparison to Q1 2016; growth rates are increasing by 50% per month and the firm expects to transact over GBP10 million ($12.82 million) per month; the firm's IFISA offering has been a factor supporting the firm's growth with 95% of the platform's investments made through IFISAs; the firm offers a variety of capital funding sources for businesses including loans as well as structured equity and debt based financing. Source

Christine Lagarde, the head of the International Monetary Fund, told CNBC that the price of bitcoin was too high but that virtual currencies should be taken seriously; “Not so long ago, some experts argued that personal computers would never be adopted, and that tablets would only be used as expensive coffee trays," she said. "So I think it may not be wise to dismiss virtual currencies.”; the interview also touches on the recent regulatory trend to crackdown on the new currencies. Source.

The IMF report is both right and wrong on cryptocurrencies. Bitcoin and crypto are indeed shaking-up the current world order; but doing so for the better, affirms the CEO of one of the world’s largest independent financial advisory, asset management and fintech organisations.