In the last few years banks have started to retrain employees on how to use various new technologies so they...

In collaboration with Energy 4 Impact, UKAid and the CME Group Foundation, the Cambridge Center for Alternative Finance has released a study on crowdfunding and P2P lending in Africa and the Middle East; Lend Academy provides details of the report in their article; covers 46 countries in Africa and 12 countries in the Middle East, featuring data on 70 alternative platforms. Source

Samsung’s new Galaxy S9 is marketed as having a better camera and can take clear pictures in low light; the technology could solve one of the bigger facial recognition issues which is poor quality pictures in low lighting; thus far banks have been slow to adopt the new technology as they have yet to be comfortable wit the way it currently works; with Samsung and Apple continuing to improve their cameras and a younger generation of customers increasing, facial recognition will soon be an important piece for all banks. Source.

China’s top ride sharing app Didi Chuxing has made the move into financial services by offering car insurance, personal loans and a...

On Aug. 30, Coromandel Capital, a secured lender and regular in the Fintech Nexus community, announced a $25-million deal with Nectar, an alternative cash flow provider for real estate and rental operators.

Afterpay operates in the buy now, pay later space and is a similar offering to other fintechs like Affirm and...

The Center for Financial Inclusion (CFI) has released a report discussing financial inclusion partnerships between financial institutions and fintech companies; findings from the report were generated from 24 in-depth interviews with individuals leading financial inclusion in the industry and highlights 14 financial inclusion partnerships identified by CFI as best-case scenarios; the partnership case studies cover four financial inclusion challenges including: access to new market segments, new offerings for existing customers, data management, and deepening customer engagement and product usage. Source

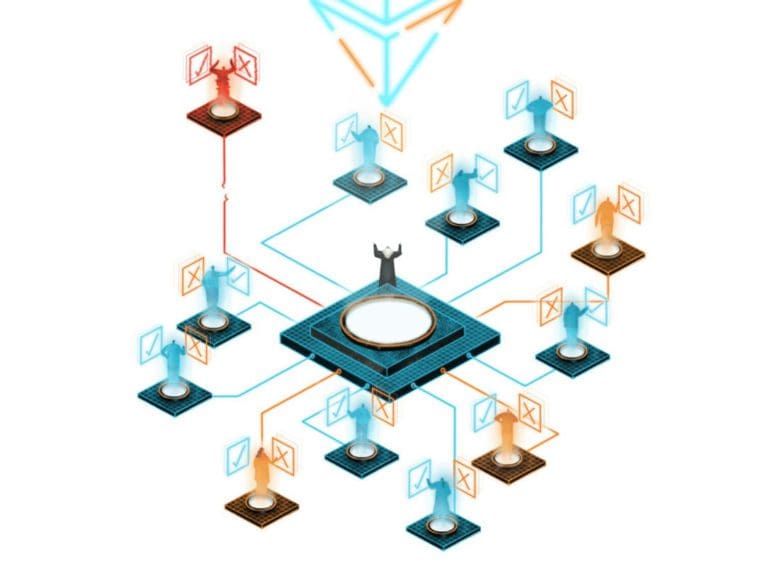

DAOs are running the web3 space, despite legal uncertainty they pose new organisation structures that could disrupt society's entire ecosystem.

Harmoney is New Zealand’s first and largest p2p lender, launching in 2014; since then they have built up a loan...

Crowdfund Insider explores the potential impact on fintech as Maxine Waters takes the helm of the House Financial Services Committee;...