Lenders today have a credit blind spot; this is because of the provision in the government stimulus package that allows...

Lenders of all stripes are starting to review their lending criteria as they anticipate seeing a wave of applications from...

FICO CEO Will Lansing said some banks are confusing customers by using a different score which he has dubbed Fako; VantageScore, the company behind the alternative scores, says their scoring is used by thousands of lenders for credit decisions and FICO is upset over competition; FICO is the most widely used credit scoring method as trillions worth of loans have been extended using FICO; JP Morgan Chase and Capital One both use VantageScore to help customers stay alerted about their credit health and not necessarily to underwrite loans. Source.

Credit unions and banks need to ask themselves if they're finding ways to say "yes" to consumers who too often hear "no" from mainstream institutions. Otherwise, they perpetuate a system that excludes the poor and people of color and drive them toward nonbanks, said Pablo DeFilippi of Inclusiv Network and other experts.

The use of rent data in credit models is allowing people with low credit scores or thin credit files to get loans. But consumer advocates warn the use of that data could harm the very people it’s supposed to help.

Marketplace crowdfunding platform Lenderwize is reporting success as the first online lending and project financing platform for telecommunications businesses; the firm offers invoice financing, project financing and equity financing with rates of return averaging 6% to 14% annually; they recently surveyed telcos in the industry finding among other statistics a cash flow market opportunity of $22 billion; the platform now has $7.3 million in borrower requests and $10 million committed from institutional investors and six equity investors; it is also expecting new capital from business development presentations at TechFluence's Fintech Meets Telecom in Frankfurt and the Fintech Circle and AngelDen's Pitch in London. Source

SMB lender Lendflow announced a partnership with Ocrolus to determine borrowers' viability and provide critical access to capital.

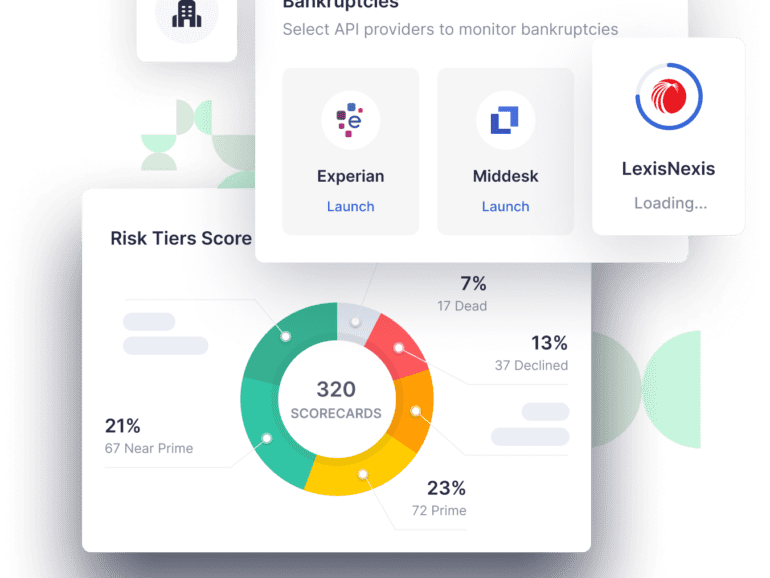

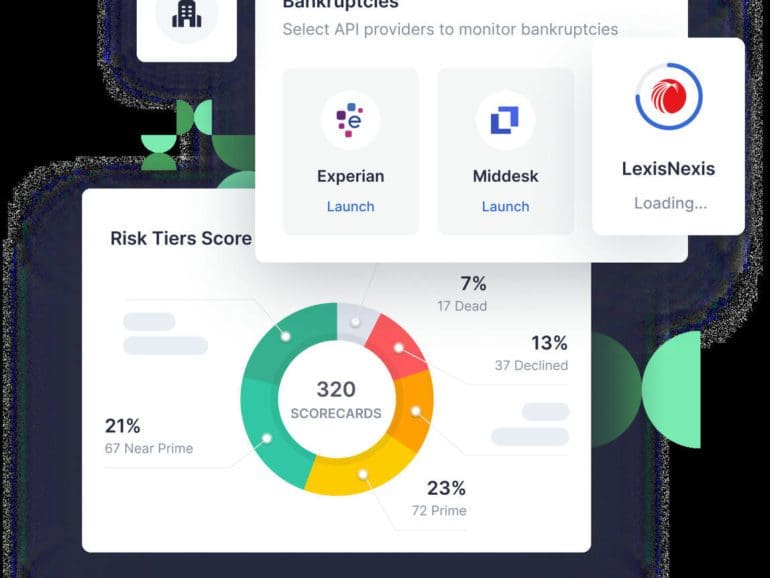

Embedded lending services provider Lendflow this week announced its new Credit Decisioning Engine that enables fintechs and vertical SaaS companies to build, embed and launch credit products

Lendflow announced its new Credit Decisioning Engine that enables fintechs and SaaS companies to build, embed and launch credit products.

Yesterday Forbes released their Fintech 50 list; since lending was one of the early segments in fintech, the companies on the list are some of the most mature businesses; Forbes shares more details on those with traction including Affirm, Better Mortgage, Blend, CommonBond, GreenSky, Kabbage, LendingHome, Tala, and Upstart. Source