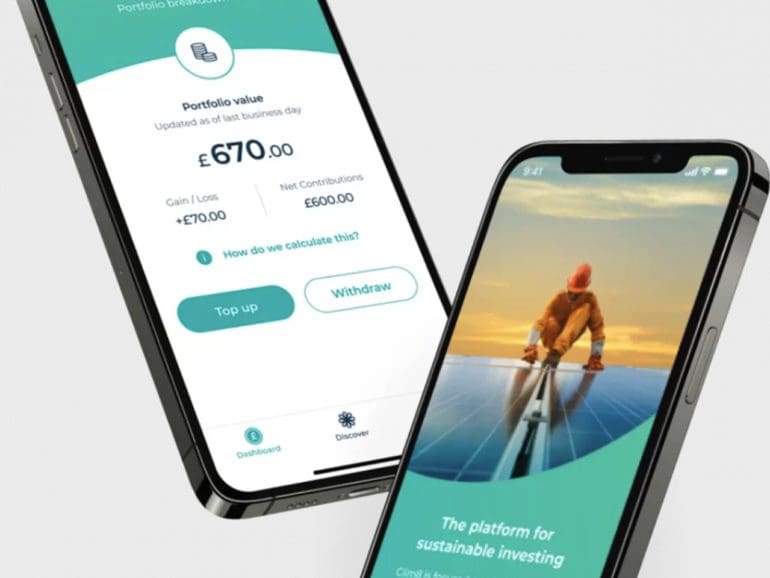

Avoiding the ESG hype, Clim8 have created a unique investment portfolio, empowering customers to make a positive impact on climate change.

Jack Henry & Associates banking division recently signed up their seventh community bank in as many months; the banks have contracted the company to use their Windows-based banking platform; Jack Briner, president and CEO California International Bank, tells Banking Technology: “When evaluating core providers, we could tell that Jack Henry & Associates would be the best partner for our bank. The advanced technology and forward momentum that Jack Henry Banking provides will give our bank the integrated and robust capabilities needed to get ahead.” Source.

Las empresas podrán acceder a las tarjetas a través de la web, con un registro inmediato de menos de 10 minutos, y de forma gratuita...

Overstock.com has announced it will allow customers to pay in over 40 cryptocurrencies through support from ShapeShift; the e-commerce website is the first well-known retail platform to allow coin payments beyond bitcoin; the payments are facilitated by an API built by cryptocurrency exchange ShapeShift. Source

The EU wants to end cryptocurrency anonymity. Blockchain bros are having none of it and are now launching a counter-attack.

SoftBank and Silver Lake are poised to be among the biggest losers betting on the fintech start-up after it took a dramatic cut in valuation to raise fresh funds.

Speaking on a panel at SoFi’s San Francisco offices designers from leading fintech companies talked about how they increase engagement...

While speaking at an event by the office of Financial Research Federal Reserve Vice Chairman for Supervision Randal Quarles talk about the issues digital currencies could pose to the markets; the current level of use doesn’t pose a risk but as the scale of usage increases so does the potential potential problem; Quarles said, “if the central asset in a payment system cannot be predictably redeemed for the U.S. dollar at a stable exchange rate in times of adversity, the resulting price risk and potential liquidity and credit risk pose a large challenge for the system.”; he also talked about the the benefits of blockchain technology and if the central bank would issue their own digital currency. Source.

In this guest post, Miron Lulic, founder and CEO of SuperMoney shares his perspective on the outlook for fintech given...

American Express and Square announced on Nov. 16 a plan to launch a new credit card explicitly built for Square sellers on the AmEx network.