On Thursday, online lender Enova International posted a $52 million profit on $320 million in revenue, up 57% from the same time last year. In addition, total originations increased 26% sequentially to a record $856 million. Despite the good news, the stock saw only a 4% rise before falling back toward its downward trend this month.

"This is a bank. We're here to empower Black America, but why are you assuming that that means we're helping poor people?" First Boulevard COO Asya Bradley said this week at Money20/20 in Las Vegas.

Prior to initiating an electronic payment, a BofA client using the service can verify the status of an account and authenticate its owner.

The move by Goldman is a sign of increased demand from large investors for information and analysis about cryptocurrencies and related fields like DeFi.

Stablecoins have gone from an obscure corner of crypto to near the center of it. Major institutions, such as Mastercard, are now trying to create alternate payment networks based on stablecoin and crypto.

Digital lending software provider Blend (NYSE:BLND) notes that the way people work — and earn money — is quite different than it was in the past. However, income verification solutions haven’t been able to catch up with the latest developments, the Fintech firm claims. As

A neobank CEO personally buys a tiny bank as the next step in building a financial super app targeting poorly-served megabank customers.

Digital payments technology is forcing the financial system to evolve. Banks feel their power waning and want to regain control.

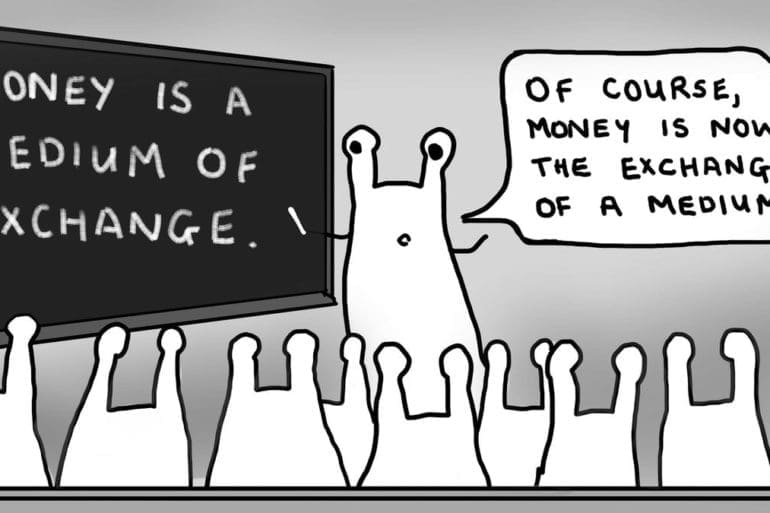

In the (very plausible) fintech vision of the future of financial services, transactions will be settled through the transfer of baskets of assets between counterparties without the intermediary of money.

The CEO of the American Fintech Council talks public policy, navigating Washington, bank partnerships, the impact of crypto and more