South Park recently did a great skit on NFTs, and one line really resonated with me: "If you believe in NFTs, then I believe in NFTs, then they believe in NFTs, and we all make lots of f**king money" … nice summary https://t.co/ZyhYFUQxH1 — Chris Skinner (@Chris_Skinner) January 1, 2022 …

Swiping through a vast inventory of images on a cell phone or laptop isn’t doing it anymore for digital art owners.

NFTs continue to play a significant role, with many platforms, communities, and individuals supporting Ukraine.

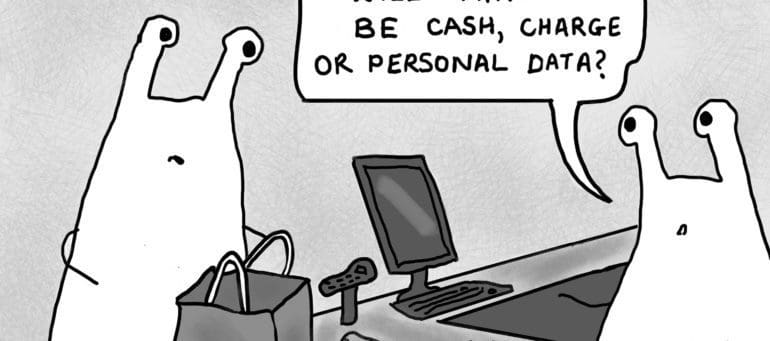

The opportunity to better engage customers with art, collectibles, swag, coupons, rewards, and financial products has broadened the base of social inclusion in crypto through NFTs with many new products and investments just around the corner and poised to superscale in Web3.

A slew of conferences, associations, new regulations and nonfungible token projects as well as the global bull market made last year an intriguing one for the region.

Perhaps DeFi (drawing on verifiable credentials and zero-knowledge proofs), rather than CeFi (drawing on federated identities and shared attributes, might kick-start the an identity infrastructure that will in turn will become its lasting legacy.

Goldman Sachs has announced they are exploring NFT's- Why? for some it's the logical next step for incumbents.

Nick Ogden has launched ClearBank after three years of development on the multi-million-pound project; the bank is marketed as a "bank for banks," targeting fintech startups, credit unions, building societies and other challenger banks; it will focus on payment processing, which it plans to offer at cheaper and faster rates than competitors, and also an "off the shelf core banking service." Source

National Internet Finance Association (NIFA) of China on August 30 released ICOs risk alerts; the Association highlights two kinds of risks: 1) some projects raise money in the name of ICO with misguided publicity and this may lead to illegal fundraising; 2) the assets of some ICO projects remain unclear and the information disclosure is far from sufficient. Source (Chinese)

Former founder of Capital One and current managing partner at QED Investors, Nigel Morris has expertise in connecting banks and fintech companies; in an interview with American Banker he talks about his career experience and current market influence at QED Investors; also discusses the investment strategy at QED Investors and some of the fintech market's leading investment opportunities. Source