The aid world’s drastic reconfiguring may have profound long-term effects on what makes for common sense within the fintech sector. ...

·

“Very few companies are going to be able to get out in this environment.“ Logan Allin is the Managing Partner...

Five Questions with Fifteenth during tax week It’s Tax Week in America, and as the IRS contemplates its next moves...

·

As the IRS confronts cuts and restructuring, fast-moving AI identity fraud is a growing threat. Can the agency meet the...

·

It is great to be back writing on Fintech Nexus again. As many of you know we closed down Fintech...

Technology changes, but consumer needs rarely do. All we want is access to varied, unique inventory and more convenience — commerce technology has...

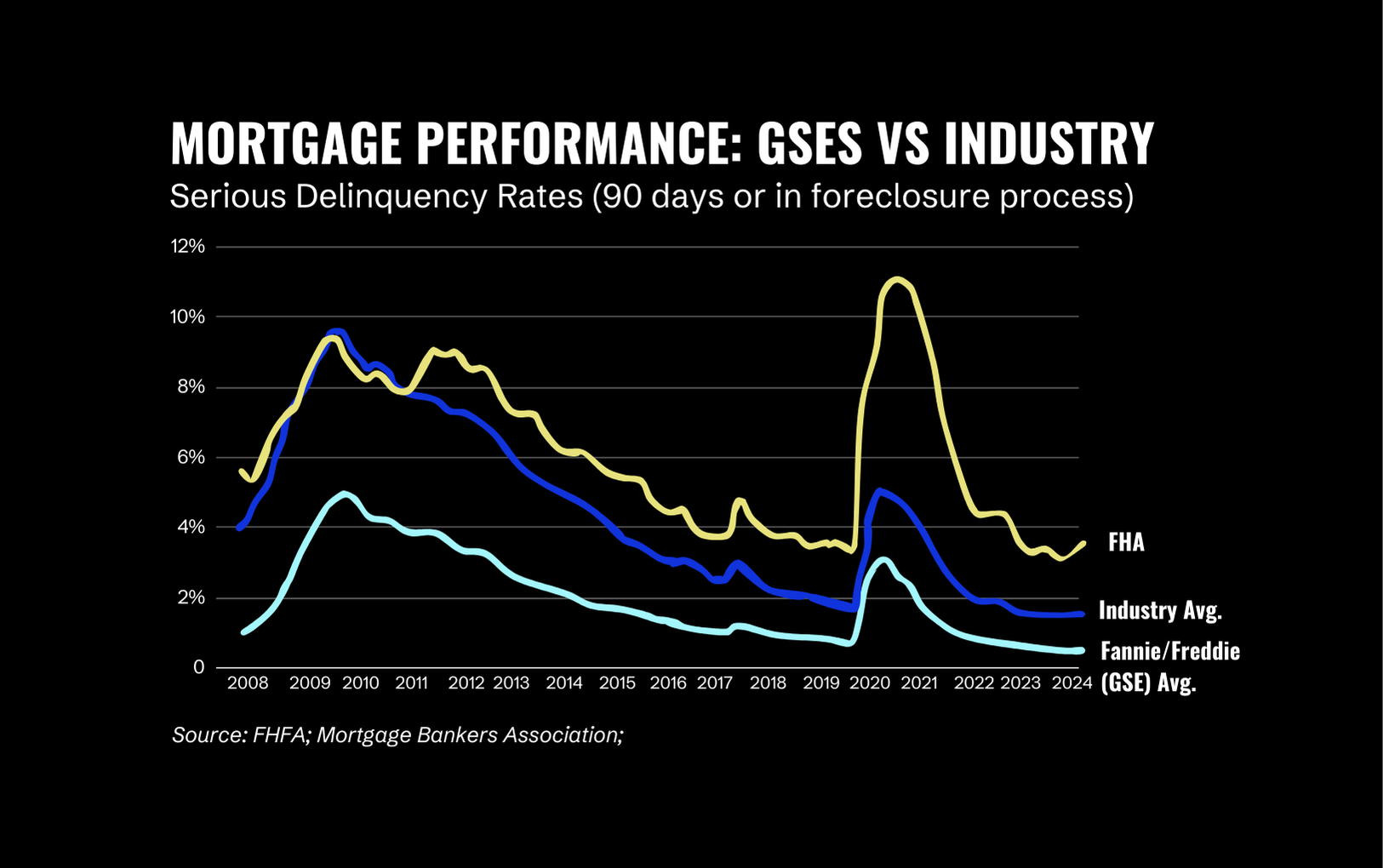

The Trump Administration has telegraphed significant changes to GSE mortgage lenders — with massive implications for the industry Since his...

With US government programs that support public data access—including weather reporting—on the chopping block, the fog is rolling in for...

·

Fintech investor Simon Wu discusses the rising popularity of the secondary exit strategy, and staying disciplined amid the AI frenzy...

The company has teamed up with Visa on card issuance driven by stablecoin tech and operates in 100 countries Count...