The week has ended in a bank run caused by the SVB's "classic balance sheet restructuring" actions. Some are asking, "who is next?"

It was one of the most tumultuous weekends in the history of fintech, as federal regulators and government agencies took swift action to stop the bleeding after Silicon Valley Bank suddenly collapsed.

Account to Account payments, or A2A, are gradually making inroads in Latin America. Credit cards dominate the market, but that could change.

These funds should allow Blipay to expand its credit line in the payroll anticipation sector — where it seeks to become a relevant player.

Over the weekend regulators raced to find a resolution for the waves made by SVB's demise. Failure of the financial system may be adverted.

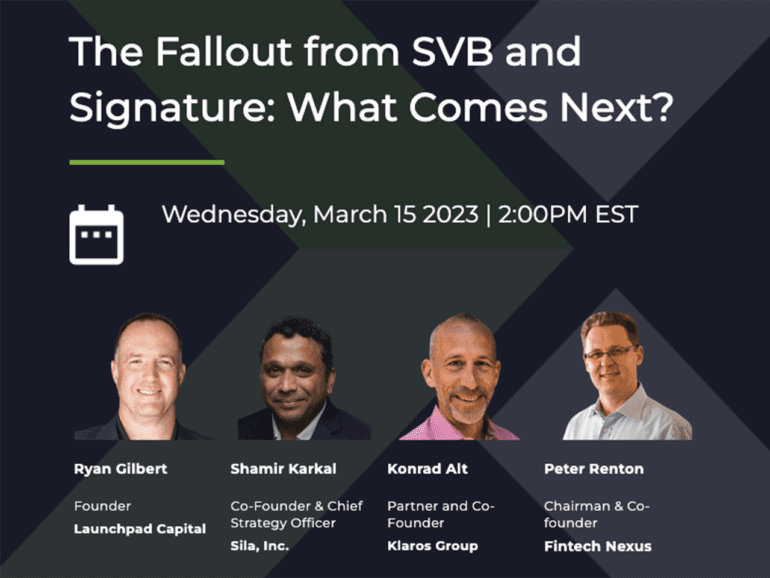

This panel of experts will examine where we are headed and how a similar event can be avoided in the future.

Mexican Konfio upsized its borrowing line with Goldman Sachs and Gramercy as it seeks to increase SME lending in the region.

OCR Labs Global claims it is the first company to independently verify that its identification verification software has been certified bias-free.

Days after the chaos, newly appointed CEO of the SVB bridge bank urges customers to hold deposits. Meanwhile regulators investigate the fall.

Mexican fintech Clara secured a $90 million debt facility as it plans to grow its footprint in South America.