The Bank of International Settlements released a new report on fintech, tokenized securities, central bank digital currencies, cross-border payments and...

The central bank’s plans aim to foster financial inclusion in a cash-based economy, the Mexican government said.

Bank of Nova Scotia, Canada's third largest bank, also known as Scotiabank, has announced a $1 billion investment in digital technology over the next three years; the initiative will focus on bringing more digital technology solutions to clients who are making fewer transactions in branches; 45% of the firm's investment will be focused on foreign markets including Mexico, Peru, Colombia and Chile; it will also be investing in new facilities for blockchain and artificial intelligence development; the firm expects the investment to help reduce costs and improve future profitability. Source

There were many new regulations added in the wake of the financial crisis in an effort to prevent the next recession; with the new administration some of the regulations have been removed and now regulators are looking at lowering a key piece of regulation; the supplementary leverage ratio requires banks to maintain capital on their balance sheet as protection; bankers have pointed out that the regulation has been hurting their ability to lend and operate; some regulators agree but there are others still on from the previous administration who believe it should stay in place; there is a fear that too much deregulation will push banks to revert back to practices that contributed to the financial crisis, striking the right balance is where regulators are currently focused. Source.

Tuesday's two-page report doesn't provide many details regarding how banks should navigate digital assets, but regulators said the industry should expect further guidance throughout the next year.

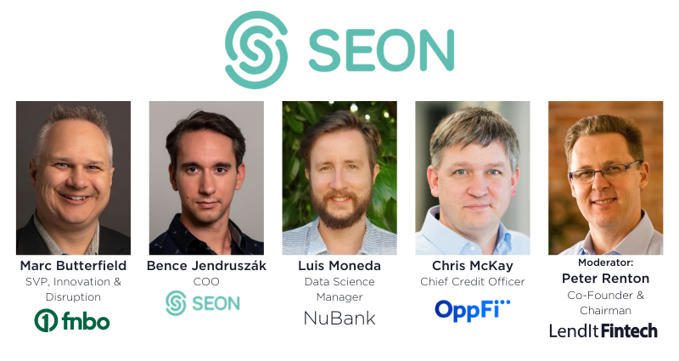

Marc Butterfield, SVP of Innovation and Disruption at the First National Bank of Omaha, said that the results were significant when FNBO ran tests.

There was a significant inclusionary difference when you improved lending through including alternative data.

The group of nine banks are experimenting with lending, secondary market and payments activities on the Provenance blockchain as they seek ways to perform basic banking tasks more efficiently.

In this week’s PeerIQ Industry Update they cover the continued growth in the jobs market with the unemployment rate dropping...

"We couldn't be more excited to, essentially, be taking the reigns and bringing a stablecoin to market hopefully later this year," Silvergate CEO Alan Lane said.