The Senate passed a banking bill meant to roll back some of the financial regulations imposed after the crisis, but its fate is uncertain in the House; Republicans in the House want a further rollback of regulations; the bill is intended to help smaller banks avoid burdensome federal oversight and raises the definition of systemically important to $250bn from $50bn; the bill also makes adjustments to parts of the Volcker Rule and eases mortgage rules for smaller lenders. Source.

This is a guest post from Tui Allen of Ampla (formerly with Shopify) about what B2B fintech startups need to focus on to be successful

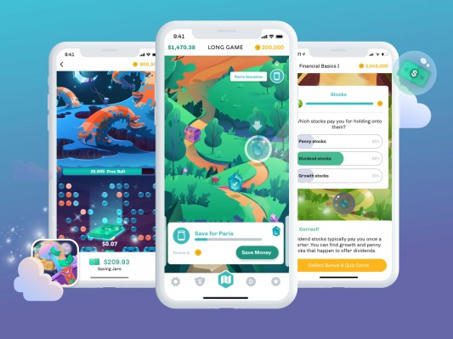

Truist acquires fintech startup Long Game in effort to reach younger demographic...

Bank advocates say that stark government scrutiny of bank forays into digital assets has been misplaced and that if the administration would like to see responsible innovation in crypto, the banking system could be the place to do it.

Banking in 2022 has a number of forecasters. Deloitte claim that banks are at a make-or-break moment. I agree. My feeling is that banks are dealing with digital transformation – a thing they should have dealt with a decade ago. For the next decade, they need to deal with investment transformation. …

Federal banking regulators issued a cloud security reminder as most banks have shifted their employees to work from home mode;...

The use of artificial intelligence and machine learning in financial services, while promising, is not without risk. It's on federal regulators to ensure that algorithms relied on by banks and credit unions aren't harming businesses and consumers.

Brett King developed his company Moven as a better solution to banking; after gaining only 60,000 customers since the digital bank's launch, he is now selling the software to banks for use in mobile apps; Moven and many other digital bank competitors are losing some of their appeal in the startup space as the Trump administration seeks to ease banking regulations that resulted in less risk taking from banks and greater opportunities for startups; as the landscape changes under the new presidential administration, it's likely that the latitude and interest from banks in partnering with startups will increase. Source

Biometrics testing and utilization increased substantially in 2016; Eyeprint ID provides market implementation details from 2016 on fingerprint, face recognition, voice recognition, eyeprint and multi-biometric strategies; the firm predicts biometrics will go beyond mobile in 2017 with use in a broader range of banking activities; also predicts improved security and user experience from biometric authentication. Source

En un mundo de nuevas abreviaturas, aparece el BaaS como forma de facilitar el acceso a nuevos servicios para las fintech. Conocé de qué se trata.