A British Virgin Islands court ordered the liquidation of the cryptocurrency hedge fund after creditors sued it for failure to repay debts.

T-Mobile recently announced a partnership with BankMobile to offer mobile money accounts to serve the underbanked population in the U.S.;...

The largest retailer in the U.S. has partnered with fintech Affirm to offer customers point of sale loans at 4,000...

Opposition to the OCC's fintech charter continues with a new lawsuit filed by the Conference of State Bank Supervisors which says the OCC does not have the legal authority to issue the fintech charter that it has proposed; the lawsuit says the OCC will need "specific congressional approval" for the charter and that nondepository companies are not considered to be engaged in the business of banking; preemption of state consumer protection laws has evoked strong opposition to the OCC's fintech charter and the lawsuit by the Conference of State Bank Supervisors is the first court action taken by an opposing party; the OCC's financial inclusion provisions, lack of clarity on state mandated requirements such as interest rate caps, default rate limitations and underwriting standards, and lack of detail on business factors including capital requirements and other balance sheet measures have caused decreasing support for the charter overall. Source

·

The lawsuit against Navy Federal has financial institutions revisiting their fair lending practices and considering how AI fits in.

The price of bitcoin is the highest in Zimbabwe which reached $13,500 at the time of the article being published; this is due to the conflicts happening in the country; for people in Zimbabwe bitcoin is seen as a safer option; the US dollar and South African rand also trade for approximately twice their price in the country. Source

Barclays is launching the My Personal Bank finance service that will link all of a customer’s Barclays based accounts; they are testing the tool with 7,500 Barclaycard Arrival Plus World Elite Mastercard cardholders. Source.

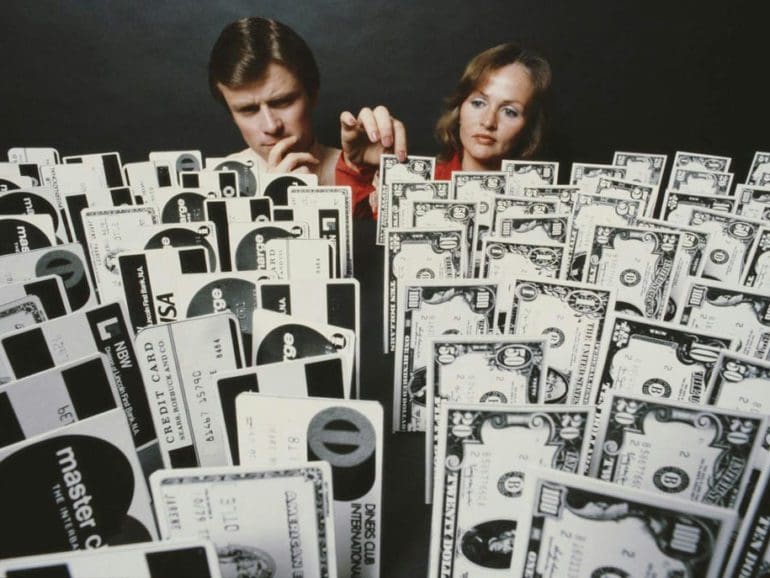

There’s a segment of the population who wish credit cards would go away, and they jump on any negative change in the credit card market as evidence of the decline and impending death of credit cards. It’s just not realistic thinking.

China represents 18.5% of the total world population and its business commerce has been growing rapidly; it also reports the four largest fintech unicorn valuations, Ant Financial, Lufax, JD Finance and Qufenqi; Matt Burton from Orchard Platform reports on these statistics and more in a recent blog post also highlighting the emphasis on mobile payments and technology services for the underbanked and unbanked; while China's fintech sector has shown exponential growth, the government is now increasing its focus on financial protection which is expected to improve the quality of fintech businesses; in the blog post, Burton also provides a list of companies he is watching by region in Asia. Source

Nomad is expanding its operations and increasing the possibilities for capital allocation to global assets.