The move to digital has brought with it a surge of fraud. Increased use of digital wallets and a rise in A2A payments have become easy targets for sophisticated fraudsters, deploying emerging technologies to prey on consumers.

Global card fraud losses reached $32.34 billion in 2021, an increase of 13.8 percent over 2020. Over the next ten years, the industry is projected to lose an accumulated $397 billion worldwide, with $165 billion coming from the US.

Financial institutions are ever more focused on the rising threat of fraud that comes with digital evolution. A new report conducted by Brighterion and Fintech Nexus found that 63% of institutions felt an increase in fraud detection would drive their AI investment.

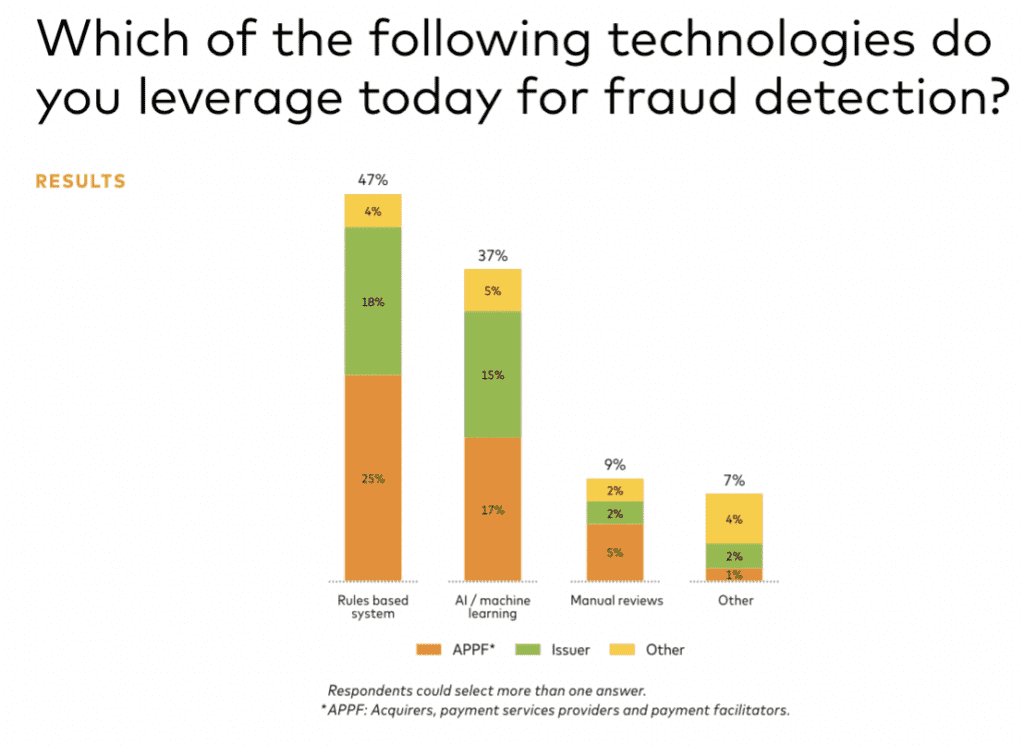

However, the current reality does not match this urgency. While 93% of respondents planned to invest in AI over the next few years, less than half had currently deployed the technology to detect fraud. In a world where A2A payments are gaining traction as a payment method of choice, this latency may have devastating consequences.

Why alternative payments pose increased fraud risks

In the report conducted by Bighterion and Fintech Nexus, it was found that, next to cards, real-time peer-to-peer (P2P) A2A payments, such as Zelle, were the most popular payment choice. Digital wallets were also popular, accounting for the payment choice of 38% of respondents. While 30% of respondents didn’t, as of yet, offer A2A payment rails, they planned to in the future.

Both P2P payments and digital wallets are fast growing in popularity. More than 5 billion people, around 60% of the world’s population, are predicted to use digital wallets by 2026.

While digital wallets use strong encryption to protect users’ information, their position on the digital plane makes them a prime target for hackers. Account takeover can pose a significant risk, opening out all of consumers’ linked cards to attack.

In addition, part of the digital wallet’s encryption process involves tokenizing the accounts held in the wallet, making it harder to spot credit card fraud. Fraudsters can link the compromised card to their own wallet, simply changing accounts if the first is blocked. This lack of friction has contributed to digital wallets becoming the vehicle of choice for payment fraud, experiencing a significant uptick last year.

Alone, A2A payments are also regarded as a weak point. Payments are often untraceable, allowing fraudsters to cut off their accounts as soon as the money is received.

Increased sophistication and speed in fraud detection are often seen as the only way to combat such risks, with AI at the forefront of technological solutions.

Ready-Made Solutions could boost deployment

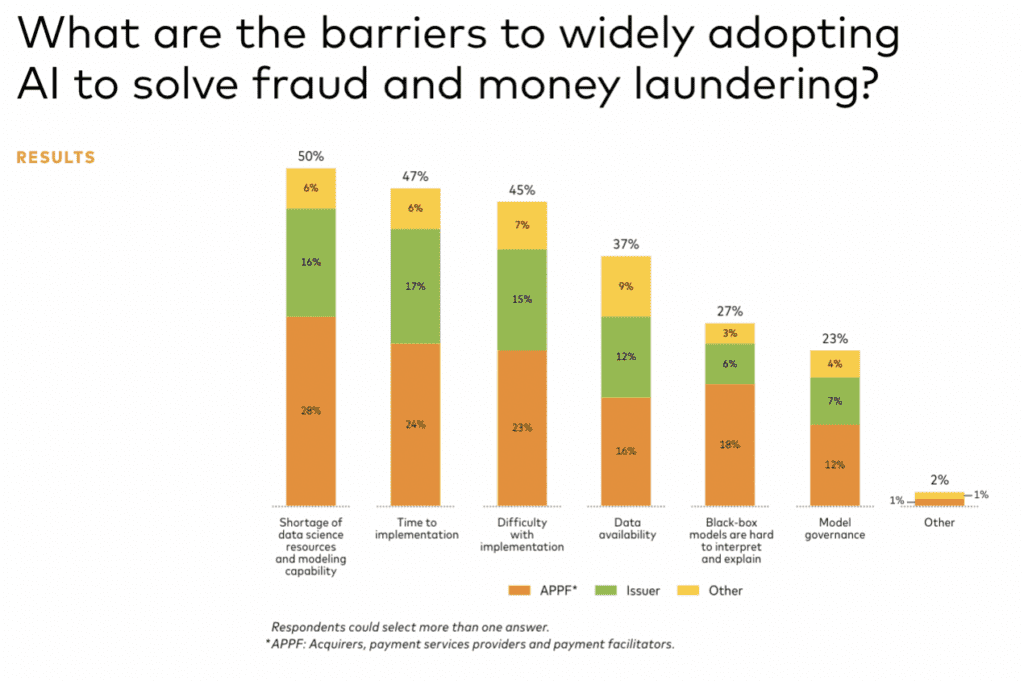

Institutions faced with the daunting task of building their own AI fraud detection unit have neither the time nor the resources to embark on a duly sophisticated solution. According to the Brighterion survey, time and a lack of data science resources are the greatest barriers to AI adoption in fraud detection. This was closely followed by the difficulty involved in the task.

Many respondents felt that the ease of deployment would greatly influence their company’s future AI infrastructure. While 65% recognized the power AI had in detecting and preventing fraud related to alternative payment options, these barriers to implementation had made in-house solutions difficult to deploy. Respondents indicated that if the technology becomes more accessible to them, they would be interested in applying it to the growing issue of fraud.

Brighterion and Fintech Nexus concluded that results showed there was a demand for outside resources and solutions. “There is a clear need for market?ready AI and machine learning solutions built with advanced training to identify evolving fraud that rules?based and other technologies can’t identify or stay abreast of,” stated the report.

RELATED: AI Perspectives: Transaction Fraud Report