Last week, Finastra partnered with FormFree to streamline e-borrowing for mortgage lenders.

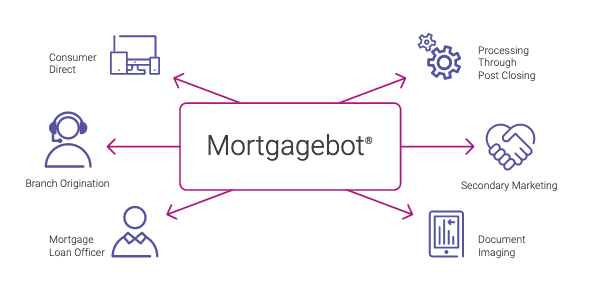

FormFree’s “AccountChek” automated employment and income verification process will fit into Finastra’s Mortgagebot underwriting product.

The CEO of FormFree, Brent Chandler, said the partnership makes optimization of the borrower verification process easier for both products.

“Notably, the integration makes it easier for lenders to support the government-sponsored enterprises’ verification initiatives that help expand access to homeownership and streamline processes without incurring the additional risk,” he said. “Combined, Finastra and FormFree’s technologies and a shared vision for fair and inclusive access to home financing will help lenders deliver an elevated borrower experience.”

Faster, transparent data underwriting

The London-based fintech software company said integrating FormFree’s tech into the Fusion Mortgagebot saves users time by making the verification process faster.

AccountChek learns borrower background through user permission data on assets, income, and employment. The firm said that the program feeds data into an underwriter-friendly report for lenders to know with complete transparency to make better mortgage decisions.

FormFree said that better data shrinks the gaps in the system that fraudulent applications could get through. Steve Hoke, VP of Mortgage and Origination at Finastra, said mortgage underwriting is typically labor intensive, but the new combined solutions streamline the process.

“For both lenders and borrowers, this added verification capability to our lending solution will have a significant impact on the loan cycle, creating a more efficient, secure, and inclusive process,” he said.

The FormFree integration is available now for Fusion Originate Mortgagebot and Fusion MortgagebotLOS users in the Americas, Finastra said.

Two SaaS companies

FormFree said it offers direct-source VOA and VOI/E data to help lenders understand credit risk like never before. Their AccountChek and Passport products “open doors to more inclusive credit decisioning” by revealing each customer’s ability to pay. the firm has provided $3 trillion in loan verifications since inception.

Finastra is a global provider of fintech SaaS. It serves institutions of all sizes across lending, payments, treasury & capital markets, and retail & digital banking. Using Mortgage Bot, the firm said customers complete 69% more applications and realized twice the revenue with the same staff. They also argue the platform reduces connection time to third-party systems by 95%.

The firm is trusted by about 8,600 institutions, including 90 of the world’s top 100 banks.