Hi there and welcome to Funded, where we spotlight early-stage bets on the future of tech. This week, we’re looking at Sola, which just emerged from stealth with an AI-native platform built to automate the operational grunt work most companies still outsource.

Sola just raised a $17.5 million Series A led by Andreessen Horowitz, with participation from Conviction, Y Combinator, and others. The startup is taking on a deeply unsexy but essential category: enterprise back office workflows. That means data entry, compliance reviews, document verification—the kind of work that’s traditionally been sent offshore or stitched together with manual processes and consultants.

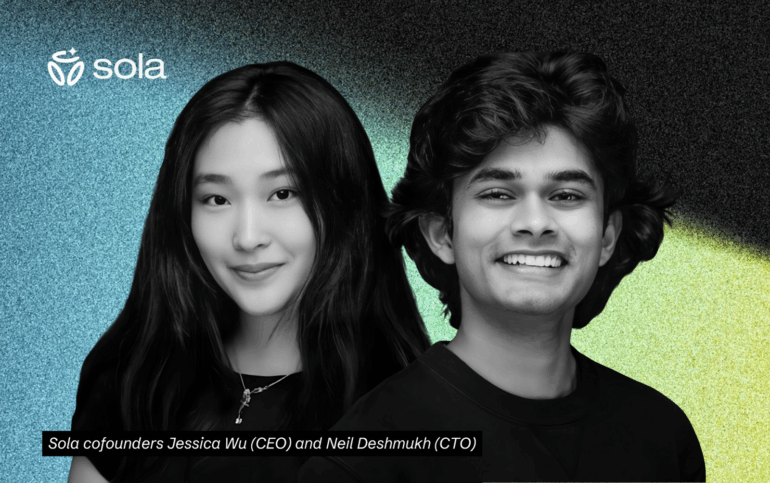

Founded by Jessica Wu and Neil Deshmukh, both MIT dropouts with deep AI and engineering roots, Sola turns real-world user workflows into self-healing bots that operate across systems, without any code or IT help. The product is already live with enterprise customers across logistics, healthcare, and legal, running production-grade automations and cutting BPO costs.

“Sola is for the people doing the work,” Wu, CEO of Sola, told Future Nexus. “The analysts, the compliance leads, the ops managers, the billing team. The people who make businesses run, and who’ve never had the tools they deserve.”

Kimberly Tan, partner at Andreessen Horowitz, said what makes Sola stand out is its accessibility to the very people who need it. “…it’s critical for AI products to make adoption easy and the results tangible to be successful. This is what we believe makes Sola particularly magical: the product’s simple interface abstracts away the incredible technical complexity required to make these agents work.”

According to the company, its bots deploy in days, not quarters, and adapt on the fly as workflows or interfaces change. The team says revenue has grown 5x since January, with workflow volume doubling every month.

Sola’s pitch is clear: legacy RPA was too brittle and expensive. This is a full-stack rethink for AI-first ops.

_

This article was drafted with the help of generative AI using company-submitted details, then manually edited and carefully reviewed by a human editor before publication.