Fintechs have upped their game on AML, and KYC controls as they face increasing regulatory pressure to protect against fraud

Instances of fraud have been steadily rising. The PwC Global Economic Crime and Fraud Survey 2022 found that 46% of organizations had experienced fraud, mainly from external actors. The top perpetrators were reportedly hackers (31%) and customers (29%), up from 24% and 26%, respectively, in 2020.

Companies need to crack down on fraud cases, resulting in additional steps and security that often require a trade-off in user experience. Extra steps and confusion with verification protocols have led to heightened frustration, with many customers abandoning the process altogether in search of easier methods.

Additionally, increased measures can require paperwork and documents that customers don’t always have to hand. In the case of lost documents, some are locked out of accounts, losing access to precious savings and investments.

Recent reports have found that in the UK, over £50 billion is currently unclaimed due to lost paperwork, ranging from pension plans to insurance policies.

Fyio has partnered with OCR Labs Global to avoid these issues, combining their secure file storage with document and id verification software. The result is expected to be a seamless end-to-end document verification and secure share function within the existing fyio ecosystem.

Expanding on an established reputation

OCR Labs have been in the space for some time, launching their solution that took five years to build back in 2018. Their focus on the sector has allowed them insights into the developing landscape and increased sophistication of fraudsters’ attacks.

Their approach aims to consider these developments while maximizing the ease of use by the customers, allowing for free image capture and simple liveness verification. This user-centric, “seamless” verification method will be shared with fyio.

“We saw in fyio a stand-out new life and document management solution,” said Russ Cohn, General Manager at OCR Labs Global. “Not predicated on accessing huge amounts of cloud storage but focused on solving a real-life problem: specifically providing a compass to guide people through modern life’s complexities, simply and securely.”

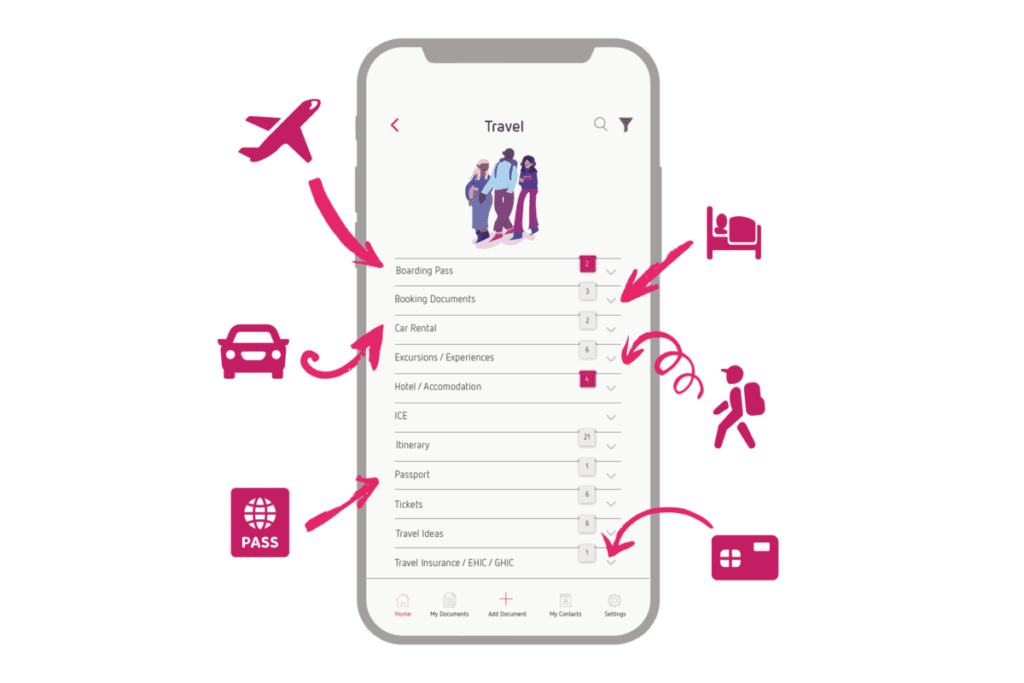

Fyio, which, until now, has focused on secure filing, storage, and sending of customers’ personal documents, is using the partnership to expand into the verification space. Customers of the future Pro product will be able to prove to the requesting parties that they are the rightful owners of the documents they send.

The resulting fyio Pro will allow users to verify documents using the tools developed by OCR Labs within the trusted security of the fyio storage space. The verified document can then be shared with the requesting party, with additional features which limit the amount of time the document is shared. This means that instead of allowing the requesting party access indefinitely, the document holder retains control of viewing rights.

Fyio’s solution ‘potentially life-saving’

One organization that relies on fyio’s secure document sharing is the Royal Marines Charity (RMA). Its CEO, Jonathan Ball, said, “The RMA likes the fyio concept because it is exceptionally simple and secure, meaning sensitive documents can be shared safely from one side of the world to the other. I believe we are delivering something to our members that is life-enhancing and potentially life-saving.”

“Fyio set out to be a disruptor and a unique problem solver in the life and document management space,” said Sarah Wrixon, CEO and Co-Founder at fyio, in the announcement of the partnership. “OCR Labs Global is the leading IDV service provider in the UK market and has a strong international presence. This partnership further strengthens our position as we plan to expand internationally and will offer the fyio community access to a simple and globally recognized document verification function.”

“In due course, all members will be able to share their verified documents securely with professional and financial service providers within our ecosystem.”

The launch date of the fyio Pro beta version is planned for 2023 with two agreed pilots in place.