The following is an excerpt from today’s Global Newsletter.

Your feel-good Friday news comes to us from Klarna this week.

The Swedish BNPL behemoth appears to be delivering on its promise from 2022 to return to profitability by the end of 2023.

After a series of outsized investments, the company’s financials were bathed in red ink, but the winds are shifting based on their latest reporting.

“The company posted a net loss of 1.3 billion Swedish krona ($120.7 million), down 50% from the 2.6 billion krona loss in the same period a year ago,” CNBC reported. “Klarna reported total net operating income of 5 billion Swedish krona, up 22% year-over-year.”

They also shared that they now have over 150 million customers and are pushing AI into their recommendation algorithm.

While it seems counter-intuitive to celebrate the reporting of a net loss, it’s important to recognize the momentum.

For those enjoying the long weekend with us, we’ll see you Tuesday.

From Fintech Nexus

By Isabelle Castro Margaroli Although generative AI’s development is a concern to some, its application to the lending sector could create even more access to credit. |

By Dan Reeve The rapidly changing landscape of finance has translated to excessive pressure on financial directors and their departments. |

Also making news

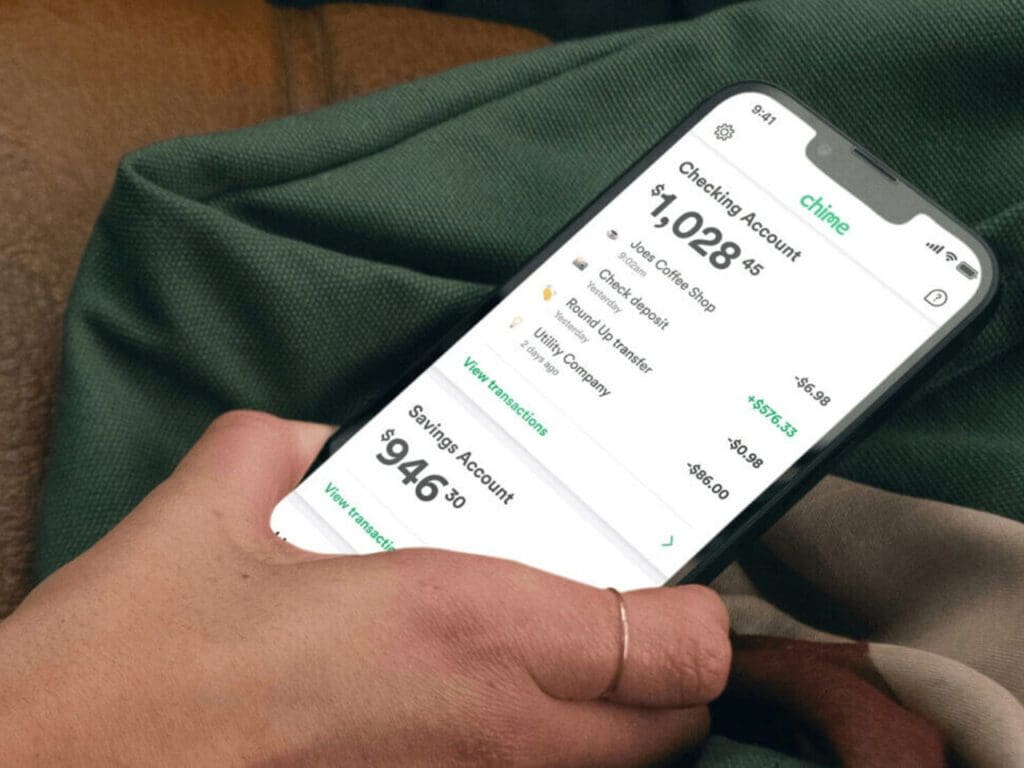

- USA: Chime’s slowdown highlights limits of bank disruptors Chime found a way to offer zero-fee banking services without being a bank itself. But that approach is starting to show its limitations.

- LatAm: Fintech Ualá scores Mexico bank license with deal approval Mexico’s bank regulator CNBV approved fintech Ualá’s purchase of ABC Capital, allowing the company to move forward with a merger that finalizes its path to a banking license in Latin America’s second-biggest economy.

- USA: OpenAI CEO raises $115M for crypto company that scans people’s eyeballs Worldcoin investor insists “Orb” iris scanner is not a “dystopian nightmare.”

- Global: Canton Network launch Signals: The tokenization of the real economy has arrived The tokenization of real-world assets on the blockchain is set to unlock a universe of new and traditional assets while broadening access to new and existing investors.

- USA: Why agri-focused fintech is sprouting Fintech is planting seeds in the agriculture industry.

- Global: Can lenders improve the financial health of consumers through design? Digital interfaces can nudge and direct customers toward healthier financial decisions. Recent work by the Financial Health Network has found multiple areas in digital lending where issuers can improve digital experiences and help customers understand the implications of their choices.

- Global: British neobank Revolut granted direct lending license in Brazil British fintech Revolut has been granted by Brazilian regulators a direct credit society (SCD) license, which should enable new products.