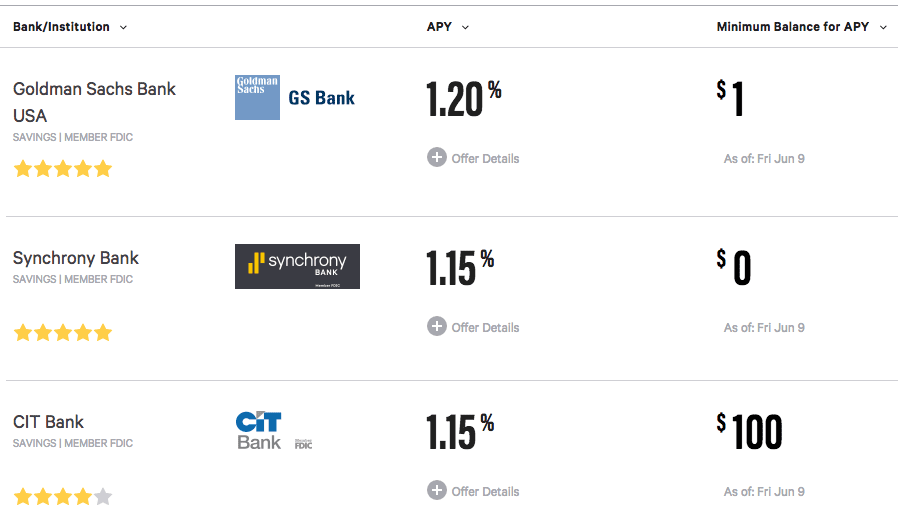

I noticed this report in Forbes last week which discussed a recent increase that Goldman Sachs was making on their savings account interest rates. As you can see in the above graphic they now offer a 1.2% return on their savings account with a minimum investment of just $1. They are aggressively seeking new savings to boost their deposits.

So, I did a bit of research on what Goldman Sachs Bank is offering compared to others in the market. I looked at Bankrate and Nerdwallet to see who were the top offerings for savings accounts and CDs of various duration. What was interesting to me is that Goldman Sachs was at or near the top in every category.

For savings accounts there were a couple of small regional or local banks that had slightly higher rates but no major national banks were higher. If you look at 3-year CDs with a minimum investment of $500 (the Goldman Sachs minimum) I could not find an offering anywhere in the country that came close to matching Goldman’s 1.90% rate. In fact, the second highest rate available anywhere for a $500 3-year CD was 1.65% from Barclays. These deposits are all insured up to the FDIC maximum.

What was also noticeable was that Goldman Sachs is advertising heavily on Google. Their ad in the search results for savings accounts and CDs was always right near the top and their display ads kept on following me around at many websites since I started this research. What was also interesting is that their ratings on the aggregator sites was usually very high, often 5-stars. People seem to like dealing with them.

While Goldman Sachs became a bank holding company during the financial crisis it is only the last couple of years where they have been embracing the retail banking side of their business. We have written about their consumer lending division called Marcus several times before and we just had their COO on the podcast last month. But we have not really looked at the other side of Goldman Sachs business – the deposit side. This is how they are funding their loans for Marcus.

Now, obviously Goldman Sachs Bank has more to offer than just Marcus. Goldman Sachs is a major lender to corporations all over the world but their banking division is looking to build up their retail deposits. Goldman Sachs had total deposits of $128 billion at the end of Q1 according to the Forbes article. The largest segment is from their private banking clients who are very different to the clients they are trying to attract online. But it is clear today they are looking to the mom and pop investor to help build their deposit base.