I write a lot here on Lend Academy about Marcus by Goldman Sachs. The reason I do so is because they are such a great example of what is possible when a well funded incumbent gets serious about fintech. Now, Goldman is an unusual case in that they have been around for about 150 years as an investment bank but they have only been a commercial bank since 2008. So, they have the big advantage of having a globally trusted brand but no legacy technology infrastructure or processes when it comes to consumer banking.

Anyway, last week at the Bernstein Strategic Decisions Conference we learned a little more about what Goldman has planned for Marcus. This is an annual event run by AllianceBernstein that goes back decades and it attracts CEOs from some of the largest companies in the world as they share plans for the company’s growth. David Solomon, the President of Goldman Sachs, and the handpicked future CEO to Lloyd Blankfein, gave the presentation.

You can listen to the full presentation here where you can also download the PDF of his slide deck. While the bulk of the presentation was on the many other Goldman Sachs initiatives towards the end he spent some time discussing Marcus. We learned that Goldman has contributed a significant amount of capital already to Marcus:

Since we started working on Marcus, we’re very pleased with our progress and have invested, through capital spend and operating losses, $600 million, including reserves. That’s up $100 million from $500 million, including reserves, at the end of 2017. It’s important to note that we’ve done this out of our operating earnings while, at the same point in 2017 and the first quarter of 2018, delivering strong returns to our shareholders.

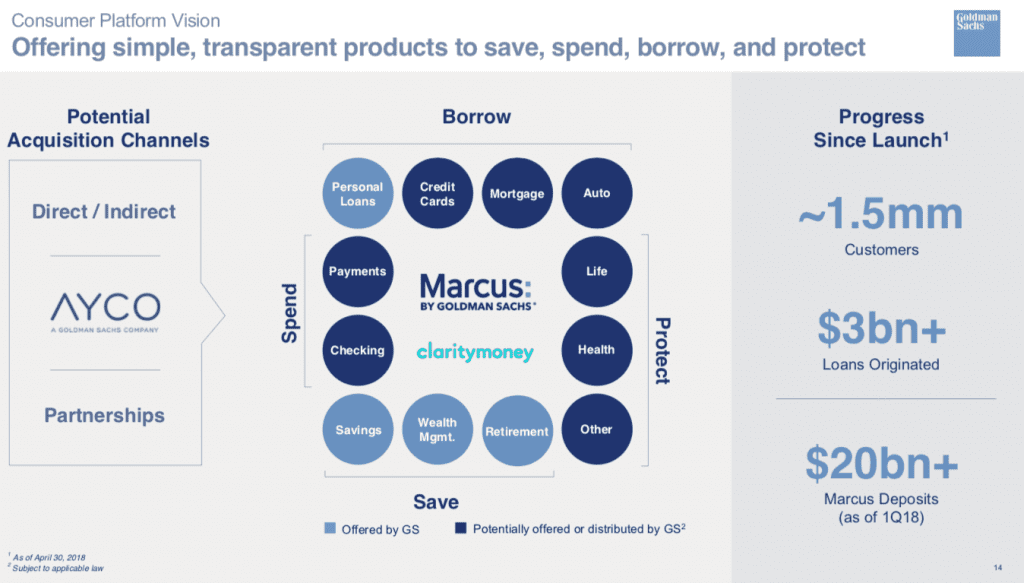

In the slide deck there was just one slide on Marcus (slide 14) but it did reveal some interesting plans for the first time. I have reproduced the slide below (click to view it at full size):

In the presentation Solomon did not address everything on this slide directly but much of it is self-explanatory. First, Goldman is breaking down their vision for their consumer platform into four key areas: Borrow, Spend, Save, Protect with 12 separate products listed. It is also interesting that Clarity Money is front and center on this slide. They clearly view the personal financial management app as a critical piece of the puzzle.

Let’s look at the future products in the Borrow space beyond personal loans:

- Credit Cards – we have already heard about their deal with Apple but there will likely be a Marcus branded credit card at some point.

- Mortgage – This is a huge market and one that still has plenty of room for disruption. While it won’t be easy to displace the banks or large non-bank lenders like Quicken Loans and loanDepot there is a huge market to go after.

- Auto – Another big market with no clear fintech leader. The banks still dominate auto lending, particularly for new cars. LendingClub has started in the auto space focused on auto refinancing and I expect that will be the area Marcus would go to first.

I should point out that for these and other potential new verticals for Marcus they do say that they will be “potentially offered or distributed by Goldman Sachs”. So, they may be thinking of partnerships here where they distribute another company’s product. My view is that most of these products will eventually be offered directly through Marcus with the possible exception of the insurance products. They have demonstrated they are playing the long game and are willing to throw resources at a problem by acquiring or developing their own products. I expect we will continue to see that pattern, certainly with the borrowing products.

In the Q&A that followed the presentation a Bernstein analyst asked Solomon what has surprised him about Marcus as they have been developing the business. His response was interesting:

I’ve been a little bit surprised at the focus around just the installment lending part of the platform as opposed to the broad vision that we have to build this platform out over time, link it to our private — link it to our wealth management business and really create a number of products and services for consumers that we think will create a more enhanced experience.

I don’t think it is surprising the media has focused on the installment lending business. Here we have one of the most successful financial institutions on the planet, who for 145 years made a big business focusing solely on the wealthiest segment of the population, decided to go in a completely new direction and offer a consumer loan or savings account for the masses. That is going to attract some attention.

When I look out over the coming decade I will be surprised if Marcus is not one of the most successful consumer finance brands. They have shown they can execute in a new market and they are clearly committed to making this a much bigger part of their business. So, I will likely continue to write about them on a regular basis as they bring more innovation to the fintech space.