A faster onboarding process for business-focused digital bank Grasshopper is at the core of its new partnership with MANTL.

Grasshopper, which relaunched a year ago and reported a significant growth in 2022, will use MANTL’s digital commercial deposit origination process to create a more favorable customer experience.

MANTL is a fintech firm offering omnichannel account origination software for banks and credit unions.

“The initial platform launch will be over the next two months or less. We’ll be live digitally opening accounts for and onboarding small businesses looking for checking/savings accounts, so deposit products,” Chris Tremont, the chief digital officer of Grasshopper Bank, said in a recent interview.

Earlier this month, Grasshopper reported a 124 percent rise in deposits to more than $549 million and a 262 percent increase in loans to more than $450 million. In comparison, total revenue surpassed $17 million, a 239 percent increase year over year.

Grasshopper focuses on SMBs

Grasshopper focuses on attracting and serving small- to medium-sized businesses across the United States that are comfortable doing business digitally.

“Our goal is to gather deposits, and we feel like that’s where you build the relationship,” Tremont said. “You have some of that data. If it becomes your main business operating account, and you’re transacting, a lot of data flows through them, where you feel comfortable making a decision. Step one is that deposit relationship.

“Offering the credit, at least you can make a pre-approval decision. Then behind the scenes, our company and MANTL work with some sophisticated know-your-business type companies that can do this, that have this data, whether it can go beyond just a FICO score, where you’re doing some cash flow and underwriting. It’s like this versus having to be on the other end of that at the bank, spending days spreading statements and underwriting a deal.

“So that’s the goal: to decide quickly on some of these smaller-dollar loans to our current clients.”

MANTL experience ‘best in class’

The New York-based Grasshopper partnered with MANTL “to enhance and streamline its existing online business account opening process, empowering the bank to unlock new revenue streams and scale efficiently while delivering best-in-class digital banking experiences to the SMB market,” according to a media release.

Grasshopper is using the Commercial Deposit Origination platform, which MANTL purports to be among the fastest and best-performing solutions on the market. This partnership will simplify document collection for Grasshopper, eliminating manual processes.

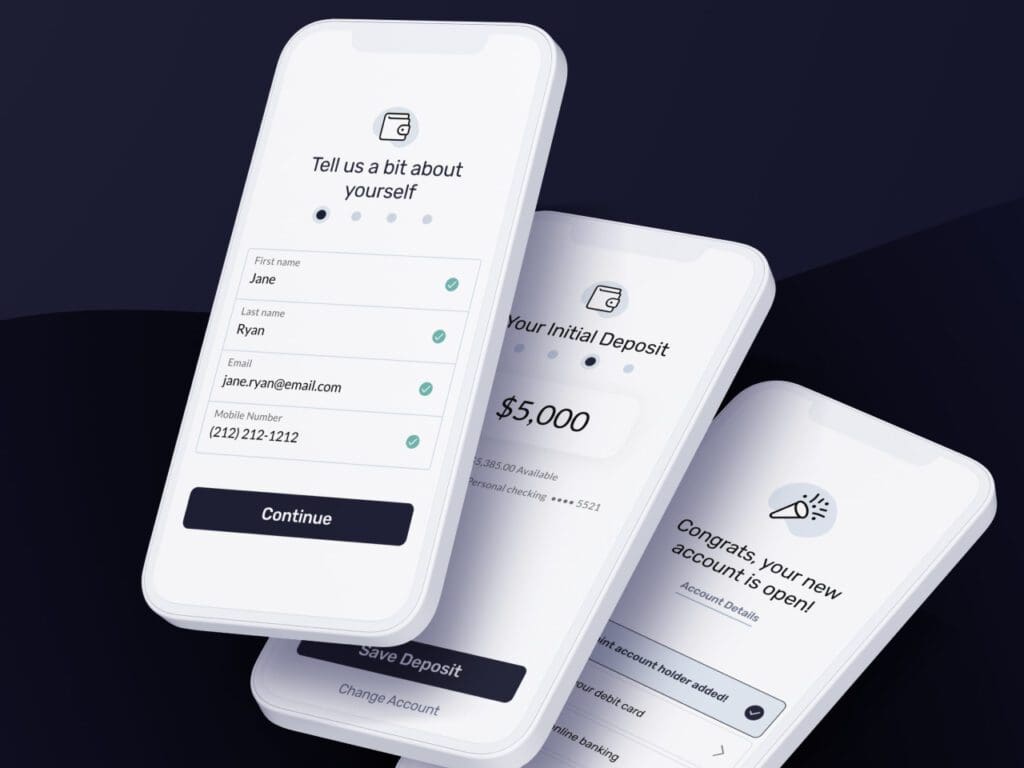

MANTL’s digital platform automates up to 97 percent of application decisions for a simple, quick, intuitive onboarding experience.

“Allowing a small- or medium-sized business to open an account in probably under 10 minutes without any paper or have to leave the comfort of their home or office to do so, we’re going to get that live,” Tremont said.

“The next focus will then be on offering those clients a loan digitally as well and being able to originate and onboard that loan seamlessly the way we did for deposits.”