Yesterday, we concluded LendIt China 2015 and what a week it has been. The LendIt team was accompanied by delegates from the US, UK, India, Russia and Australia. Not only were our attendees located across the globe, their reasons for attending varied as well. With over 2,000 p2p platforms in China, some were looking for potential investments. Others are planning to launch their own platform and were looking to learn from the Chinese market. Some were simply looking for networking and partnership opportunities. Attendees were also able to form lasting relationships with other attendees as they spent the week enjoying conferences, private dinners and cultural events. This overview will just give you a taste of the experiences we had over the last week as we immersed ourselves in the Chinese culture and delved deep into the largest p2p lending market in the world.

LendIt in Bejing

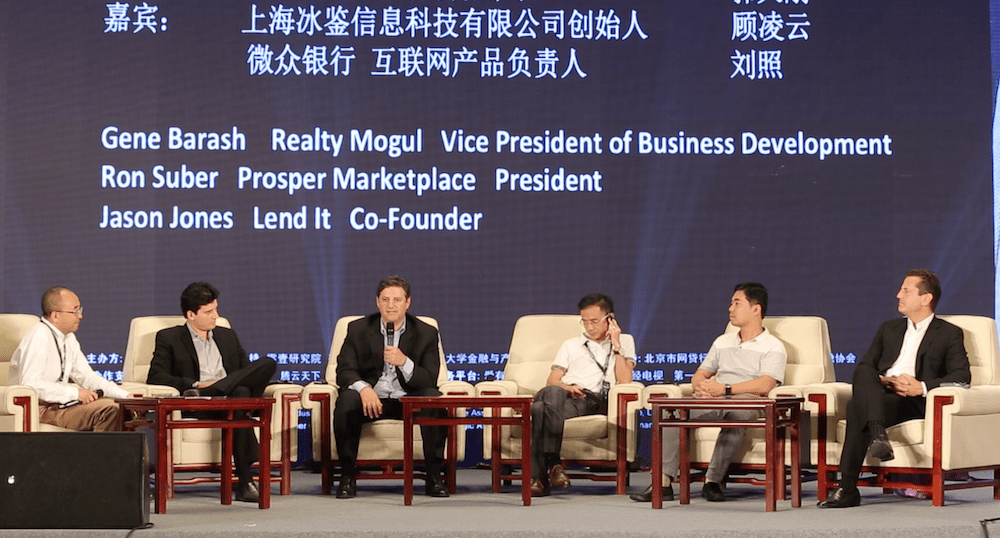

Our trip started in Beijing with the Mobile App Show. We heard from many different p2p lending companies, but also had several of our delegates speak. Jeremy Todd, Head of West Coast sales presented about Orchard and the best practices of marketplace lending. Others who joined us spoke on panels, including Ron Suber (President, Prosper), Gene Barash (VP of Business Development, Realty Mogul), Jason Jones (Co-Founder, LendIt) and David Ruddiman (CEO, LendEx).

CreditEase sponsored our cultural trip the great wall. Afterwards, we went to their offices and heard CEO, Ning Tang talk about their business. They then hosted a private dinner where we enjoyed several different dishes that included peking duck.

Before leaving Beijing on the bullet train to Shanghai, we visited the offices of Jimubox. They talked about several of the things they do differently, including customer acquisition and underwriting.

LendIt in Shanghai

After arriving in Shanghai, we immediately went to a dinner on the Bund hosted by Lufax, one of the biggest p2p lenders in the world. Over the weekend we were a part of the Bund Summit, a two day event dedicated to internet finance. We also welcomed new guests to join us on the second half of the tour. Several of our delegates spoke on panels in packed rooms. Keynotes were given by Matt Burton (CEO, Orchard), Ron Suber (President, Prosper) and Christine Farnish (Head of the P2PFA in the UK). One thing I noticed throughout the tour was that although we were here to learn about the Chinese market, many people were eager to talk to our delegates.

While in Shanghai, each night we met with a different company to enjoy either an intimate dinner or a party. Companies included China Rapid Finance, Quark Finance and Dianrong. Dianrong hosted a press conference on our last day and invited many members of the media. There was a panel discussion followed by questions from the media.

For me, the most interesting parts of the trip was meeting with the different companies both in Beijing and Shanghai. The LendIt team has a deep relationships with many of the largest p2p lenders and it was great to hear about each company in a more informal setting at their offices or at dinner where we could ask top executives questions. The hospitality by each and every company that sponsored a dinner was incredible.

Throughout the event, we had a camera and video crew on staff to document all of the events and activities. We have over 2,000 photos and many videos as well that we are excited to share. Be sure to keep an eye out in the content section of LendIt.co to learn about the Chinese market and to get a better idea of what you can expect at LendIt China 2016.