The British neobank, serving over 40 million customers globally, has acquired a banking license in Mexico.

As artificial intelligence (AI) provides new tools to criminals, Incognia's tools are 17 times more effective than facial recognition.

Lending is going through a new wave of innovation and we want to hear what is most interesting and important to you.

Salt Labs, which helps lower-income workers but does not subtract from their earnings, has recruited Ted Benna, the father of the 401(k), as an advisor.

Brazilian neobank Nubank partnered with Wise to launch a global account. The online lender is targeting the highly affluent in Latin America.

Cybersecurity needs to be a focus for fintech companies right now. Here are the most important factors to consider to ensure strong cybersecurity governance.

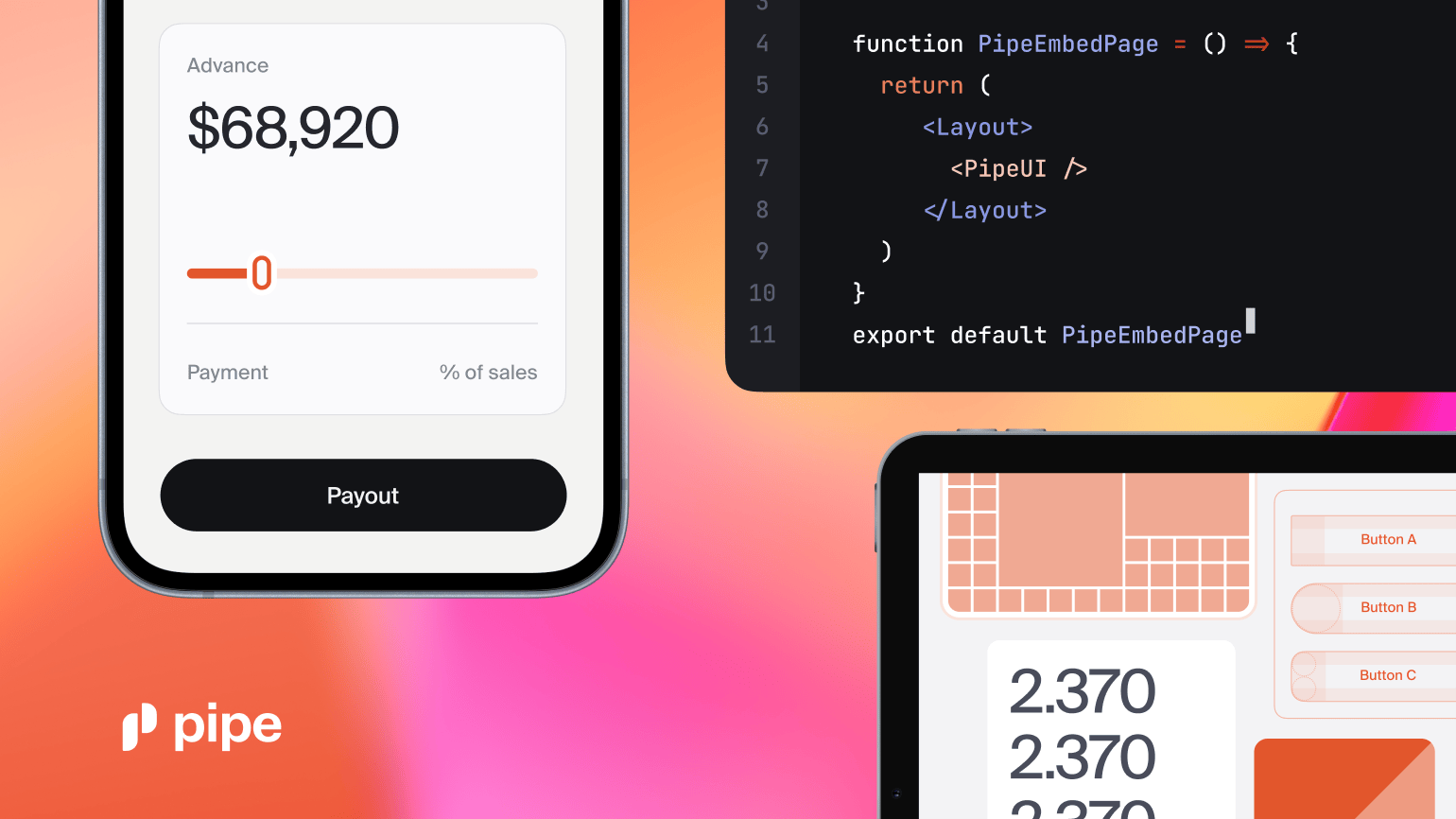

Pipe is launching a new embedded finance product to help small businesses. Their Capital-as-a-Service product has three launch partners.

Fintech Nexus is for sale and we are currently seeking expressions of interest.

After Pix and Open Finance, the central bank of Brazil is closing in on the launch of Drex, its central bank digital currency.

A new report from Open Lending and TransUnion dispels the myth that many thin-file consumers, especially younger ones, are more risky.