Last year, 16 fintechs were authorized in Mexico. Among them, Albo, Belvo, Todito Pagos, Mercado Pago and Femsa's Spin by Oxxo.

·

An EO From the Trump administration mandates the government to modernize payments–but may not move the needle much In late...

·

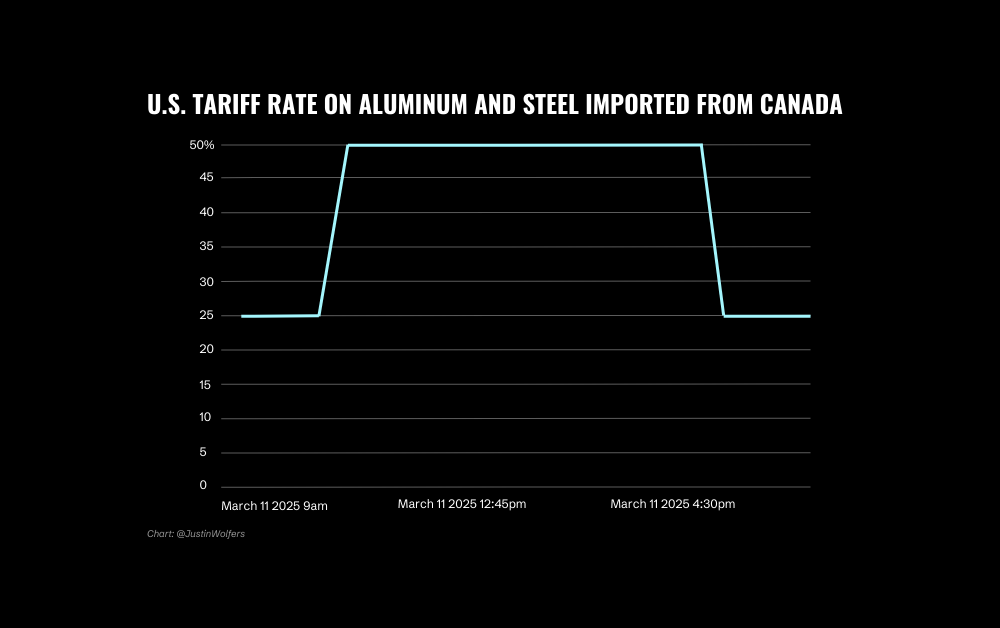

With an “A/B testing” president in office, financial models may offer clarity It’s a new era for business as this...

Venture capital funding to LatAm startups droped 70% to $1.3 billion in the quarter, down from $4.1 billion in the year-ago period.

·

Hi there and welcome to Funded, where we spotlight early-stage bets on the future of tech. Today’s issue highlights a...

Real-time payments systems have globally increased the threat of related fraud. Will FedNow follow the trend?

Credit granted by fintechs in Brazil reached 55 billion reais in 2021, up tenfold in the 2016-2021 period, according to Serasa Experian.

Brazilian QI tech tapped $200 million in a landmark Series-B investment deal, one of the largest rounds in Latin America this year.

As the digital economy expands, chargebacks will remain a vital consumer protection tool. The onus is on financial institutions to adapt to this changing landscape, ensuring that chargeback processes are efficient, transparent, and aligned with the evolving needs and expectations of consumers.

Alkami’s Digital Sales and Service Maturity Model shows banks and credit unions how they digitally stack up against the competition.