Compared to most other areas of daily business operations, accounts payable and receivable have been starved for innovation since Quickbooks’ debut decades ago.

Anchor co-founder and CEO Rom Lakritz believes the technology exists to provide a $10-trillion process with a long-overdue upgrade.

An accountant and lawyer by training, Lakritz has also been a consultant, venture capitalist, and on the founding team of five startups. He’s done his share of billing, paid his share of invoices, and spoken with dozens of business owners and AP/AR people. The significant time spent on these needlessly manual processes takes away from growing companies.

“What hurt me most is to think about it all the time, about money coming in and the cash flow,” Lakritz said. “It was something that, for a business owner, you don’t know what’s going to happen. It’s something that is always on your mind.”

The issue stuck with Lakritz as he built, listed, and sold companies. A decade ago, there was no way to solve it — no Stripe, no Plaid. It was only in 2019 that the technology existed, and Lakritz saw the time was right to provide the first B2B payments innovation since Quickbooks. E-commerce, SaaS, artificial intelligence, and machine learning made autonomous billing possible. Blockchain technology, while considered, wasn’t needed.

How Anchor solves the problem

Simplify accounts payable and receivable, and you’re tackling a $10-trillion annual task, Lakritz said. That’s on top of as much as 2% of paid invoices that are duplicates and the average 4.6% of work that never gets invoiced.

The issue is a human one, he explained. Humans send invoices, and humans have to check for accuracy and fraud. If a problem is discovered, the back and forth begins. Time and human capital are wasted.

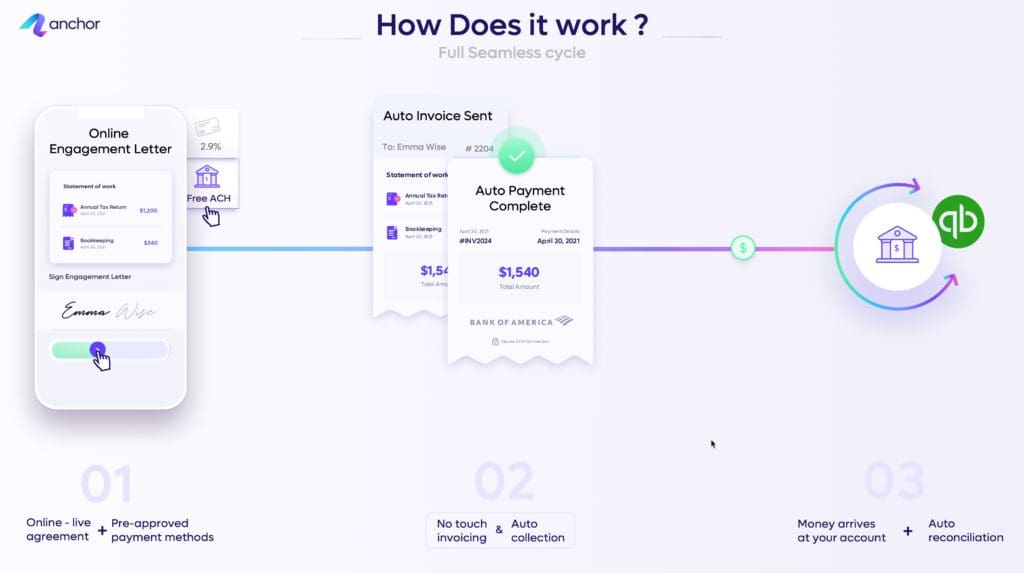

As he delved into the problem, Lakritz soon learned that any solution must include the agreement the sides sign at the beginning of the deal. The engagement letter becomes a living document and the single source of truth for both parties.

The customer provides payment details at the onset, both parties agree on terms like fees and scheduling, and a cloud agreement is created. Invoices are generated automatically, payments are automatically made, and accounts are reconciled.

Also, see:

“Once you’ve completely automated accounts on the receivable side, the accounts payable side doesn’t really need to look at invoices because we eliminated the B2B risks in payments, and you don’t have errors anymore,” Lakritz said. “You don’t have the risk of fraud anymore. You don’t need this expensive process of accounts payable. It’s changing everything.”

Unlocking value

No one questions their Amazon invoice, he added. There’s no need to question if Zoom bills you for 20 accounts. Anchor wants to bring the same experience to B2B payments.

Think of this evolution’s value to all sizes of business, but especially smaller ones, Lakritz said. Instead of the office manager reading invoices and chasing down payments, they can market, generate revenue and grow the company in other ways. When AP or AR action is required, it takes seconds.

“Nobody needs to do anything,” Lakritz said. “You’ve saved so much time, and if you took it if you look at the price, you save two signatures and DocuSign, which is more expensive than that feature on anchor. You save that time, which is about an hour per invoice.”