Investment with a purpose is on the rise. ESGs have become a hot topic of conversation, media mentions on the subject rose 303% in 2020, and according to The Global Sustainable Investment Review investments in sustainability-focused assets grew to $35.3 trillion globally.

Over the last decade, green bond issuance has risen significantly, reaching a value of over $500 billion in 2021 alone. This has made bonds a major tool for improving global sustainability.

Intercontinental Exchange (ICE) recently released a suite of corporate bond climate indices to support this growing demand.

Slow progress makes investment critical

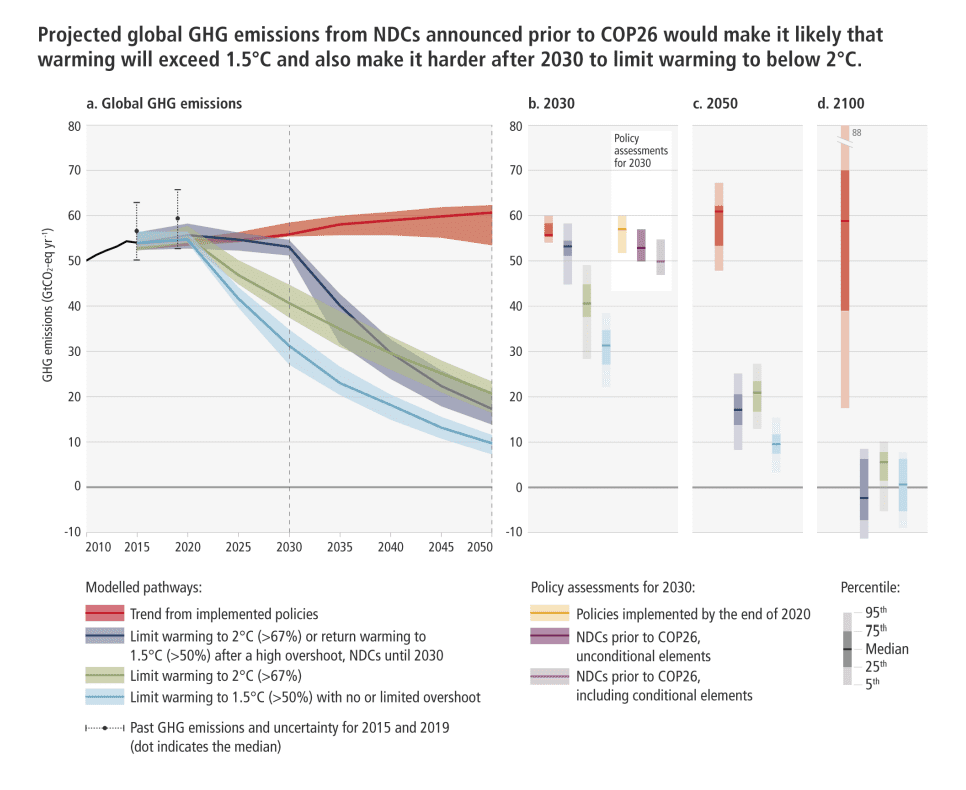

The race to reduce carbon emissions has become critical. Since the COP21 Paris Agreement of 2015, climate change has become a significant part of many nations’ political agendas. In response to the UN’s Intergovernmental Panel on Climate Change (IPCC) recommendation to limit global warming to 1.5°C, signatories of the agreement have set the target of being net-zero by 2050.

However, progress is slow. Despite steps being made, the earth is still on track to exceed this recommendation and continue to warm even further. To reach the goal of 1.5°C, emissions would need to be at their peak in 2025 and reduced by 43% before 2030. Significant changes are therefore required to curb this rise.

Green Bonds are seen as a powerful aid in reaching these goals. Aimed at supporting sustainable businesses, the combined issuance of Green, Social, and Sustainability bonds reached $767.5 billion in the first three quarters of 2021. The bonds represent a substantial amount of funding for sustainable initiatives, incentivizing corporate adoption of practices that support climate change objectives.

“The goal of carbon reduction has become a key focus for investors, as they begin to look at not just promises of change, but at actions companies are taking to achieve their emission goals,” said Varun Pawar, Head of ICE Data Indices.

Varients support a reduction in carbon emissions

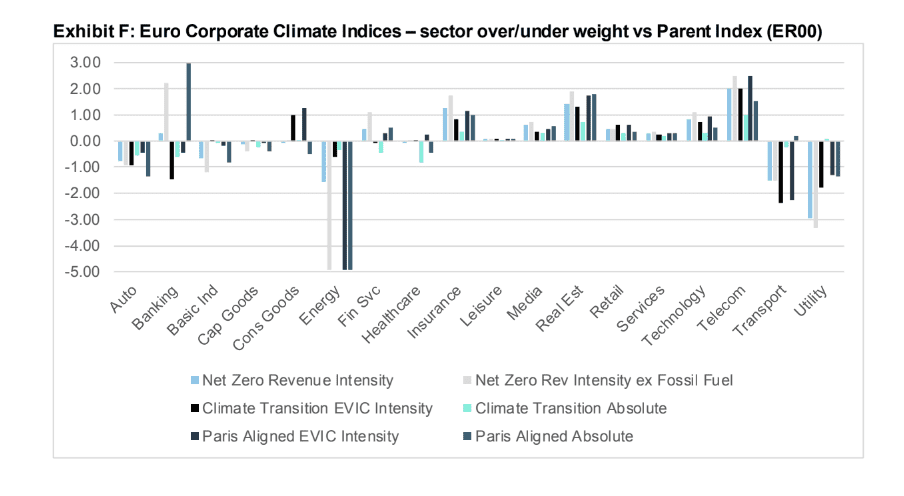

Leveraging 23 of ICE’s existing corporate bond benchmarks, the company has formed a group of 138 climate indices set to expand according to investor requirements. The group is divided into 6 separate variants using different screening, with a focus on carbon emissions reduction.

Two of the variants meet the requirements to be labeled as Paris-Aligned Benchmarks, and a further two meet the criteria to be labeled as Climate Transition Benchmarks under the European Union (EU) and UK Benchmarks Regulation (BMR). Two other variants follow a similar methodology but use a revenue-based carbon intensity metric. All six variants seek to support goals to achieve net-zero carbon emissions by 2050.

In addition, the variants have the same environmental, social, and governance (ESG) focused exclusionary filters and three have additional filters targeting specific fossil fuel-related business involvements.

The application of the indices results in a vast reduction of the constituents from the parent index without too much variance in risk exposure. The notable outliers, perhaps unsurprisingly, mostly fall in the energy sector.

ICE also found that constituents of the climate variants had higher performance in annualized return when compared to the parent index, with the Net Zero variant performing best at +0.26%.

“This new suite of indices brings together several of ICE’s strengths – its leadership role in fixed income securities and global environmental markets, experience creating innovative sustainable benchmarks, and ability to deliver products that match investors’ current and future needs,” said Pawar.

RELATED: