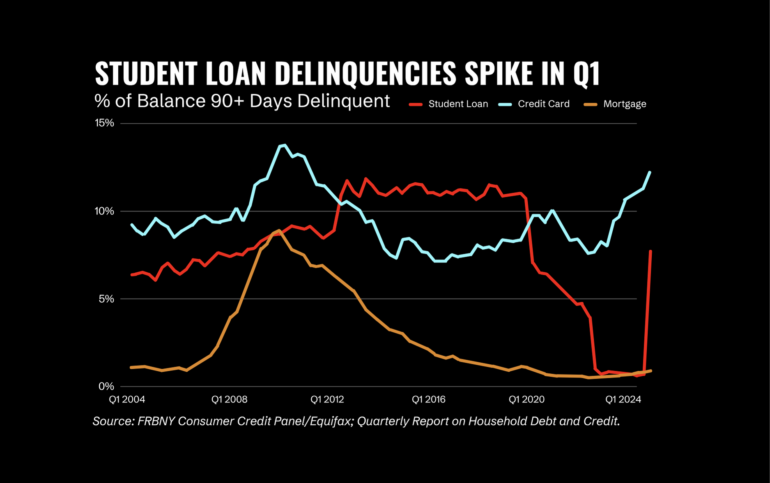

$250 billion in now-delinquent debt is hanging over millions of consumers as the Trump administration’s policy changes may mean a massive economic hit.

In March 2020, at the onset of the COVID-19 pandemic, the federal government suspended most federal student loan payments and brought many interest rates for these loans to 0%. With the resumption of interest and payments in the fall of 2023, more than 9 million borrowers fell behind on their student loans, representing more than $250 billion in now-delinquent debt. Eyeing market and policy shortcomings, a cohort of fintechs has popped up over the last decade to help borrowers manage, mitigate, and pay down debt, from assisting with consolidation to helping qualify for elimination.

As of last week, following policy changes under the Trump Administration, borrowers may see hits to their credit scores, wages garnished, tax refunds seized, and reductions in social security benefits. To make sense of how these changes may affect student loan-focused fintechs, as well as their impact on the debt and financial health of US consumers, we interviewed Laurel Taylor, Founder and CEO of NYC-based student debt and savings optimization platform Candidly.

The following has been edited for length and clarity.

The Trump Administration recently resumed collections of federal loans — even as a record number of Americans have fallen behind on their payments — and announced it may garnish wages come summer. Do these changes affect Candidly and its users? If so, how, and does any recourse exist for borrowers?

The Trump administration’s resumption of federal loan collections and planned wage garnishment this summer directly impacts millions of borrowers, including Candidly users. With approximately 5 million Americans in default facing potential wage garnishment, many borrowers are urgently seeking guidance through this transition. Candidly’s coaches are already fielding calls from concerned borrowers who report experiencing extremely long wait times and limited assistance when contacting the Default Resolution Group. Candidly users navigate their options through repayment optimization tools and guidance from Certified Student Loan Specialists, who assist borrowers with understanding the primary recourse options: loan rehabilitation (making 9 affordable payments over 10 months) or loan consolidation (combining loans into a new direct consolidation loan), both of which can halt collection activities. This support is essential as borrowers navigate an overwhelmed system, helping them avoid severe consequences of default that can include credit score drops of up to 140 points and garnishment of up to 15% of disposable income.

How is Candidly doing? Any announcements to share with Fintech Nexus?

Candidly is experiencing tremendous growth. Our student loan retirement match solution has seen a significant uptick in adoption, with Q1 2025 onboardings tripling what we saw in all of 2024. We’ve also achieved a 121% CAGR in median employee adoption across large, mega, and jumbo-sized employers. Additionally, on April 29th, Schwab announced a collaboration with Candidly to expand its student loan retirement matching, student debt management, and college planning resources.

What does Candidly’s roadmap and outlook look like for 2025, especially given the downstream effects of economic uncertainty?

Candidly’s 2025 roadmap is strategically positioned to address the downstream effects of economic uncertainty. This goes well beyond student debt, as that crisis, a savings crisis, and retirement savings crisis are inextricably intertwined. As economic conditions fluctuate, we’ve observed a fundamental shift in how employers and individuals view our services; what was once considered a “nice-to-have” benefit becomes a “non-negotiable” financial essential. Our outlook remains strong specifically because economic uncertainty amplifies the need for our solutions, as demonstrated by our employer offerings which deliver measurable ROI through reduced turnover (currently showing up to 58% reduction in churn among users, depending on the program) and improved productivity — critical metrics for companies navigating challenging economic conditions.