Yesterday, the Innovative Lending Platform Association (ILPA), made up of small business online lending leaders OnDeck, Kabbage and CAN Capital, announced SMART box, an initiative to provide transparency to small business borrowers. We caught up the Kathryn Petralia, Co-Founder & Head of Operations at Kabbage to learn more about the SMART Box

The ILPA along with the Association for Enterprise Opportunity (AEO) engaged small business stakeholders, owners and advocates along with other lending platforms, policymakers and not-for-profit organizations to create the new SMART Box. Kathryn shared that their conversations also included OCC and Treasury officials.

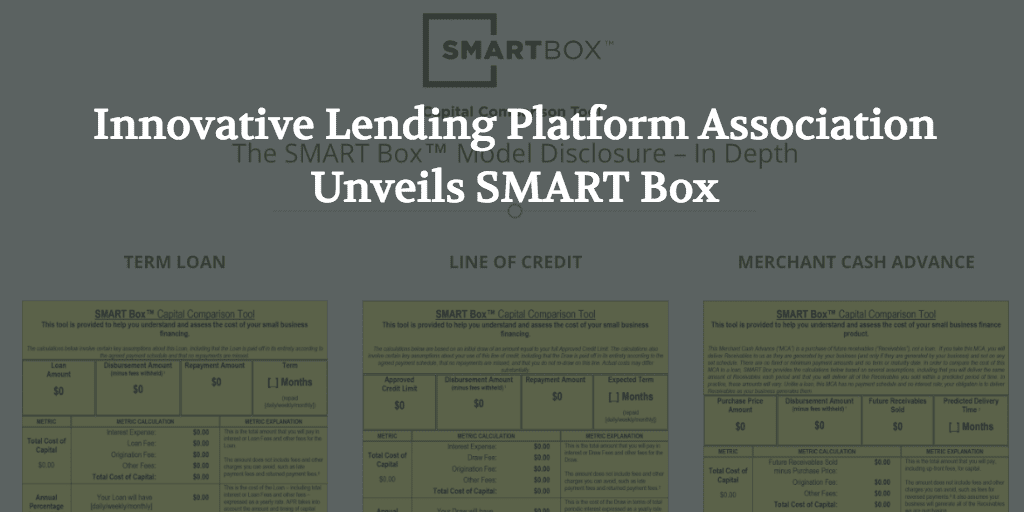

SMART stands for Straightforward Metrics Around Rate and Total cost. It provides consistent verbiage and standardization of pricing across loan products including total cost of capital and annualized percentage rate. The ILPA have broken out three versions of the new disclosure box for different loan products: term loans, lines of credit and merchant cash advances. Each disclosure highlights the differences of each product while communicating standard pricing and consistent verbiage to the borrower. There will also be third party validation done by Navigant Consulting, who will validate APR calculation methodologies to ensure they are consistent with principles of Regulation Z (The Truth in Lending Act).

An in-depth look at each disclosure box is available on the ILPA website. Kathryn noted that each disclosure is a living document and there will be subsequent versions to improve them.

There are two parts to the SMART box. According to ILPA website:

The first part presents basic elements of the finance option under consideration, including the amount financed, the funds disbursed, the total repayment amount, the expected term, and the frequency of payback (as applicable).

The second part of the SMART Box presents four common pricing metrics: total cost of capital, APR (estimated for merchant cash advances), the average monthly payback, and the cents on the dollar cost of the financing option.

The SMART Box also breaks out the prepayment policy, if applicable on the loan. If there are prepayment fees that are are not captured in the SMART Box there will be a reference to the loan documents where any additional fees are outlined. There is also a breakout if prepayments will result in any reduction in interest or applicable loan fees.

SMART box will be rolling out in early November. Here is what Kathryn had to say when we asked her to summarize what the SMART box means.

The SMART Box is all about transparency. We want to enable the small business borrower to have a complete look at all the details of their financing. It is also a sign of maturity in the online small business lending industry.

Conclusion

Providing disclosures like the SMART Box is simply the right way for online lenders to do business. Disclosing full transparency around the cost of credit in the small business space, especially with a merchant cash advance products, is something that hasn’t been done adequately before. The ILPA isn’t the first organization to have announced such an initiative as Fundera announced their disclosure box last month. Hopefully we will see the trend towards transparency continue. While this will please regulators, more importantly, it will provide small business borrowers with all the information necessary to make an informed decision about their credit needs.